During the year, Eugene had the four property transactions summarized on the next page. Eugene is a

Question:

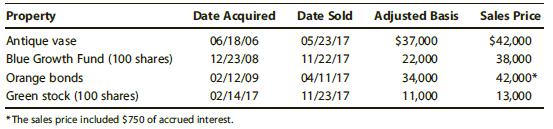

During the year, Eugene had the four property transactions summarized on the next page. Eugene is a collector of antique glassware and occasionally sells a piece to get funds to buy another. What are the amount and nature of the gain or loss from each of these transactions?

Transcribed Image Text:

Property Date Acquired Date Sold Adjusted Basis Sales Price Antique vase Blue Growth Fund (100 shares) 06/18/06 05/23/17 $37,000 $42,000 12/23/08 11/22/17 22,000 38,000 Orange bonds 02/12/09 04/11/17 34,000 42,000* Green stock (100 shares) 02/14/17 11/23/17 11,000 13,000 * The sales price included $750 of acaued interest.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (12 reviews)

Differnce between long term capital gain and short term capital ga...View the full answer

Answered By

Marvine Ekina

Marvine Ekina

Dedicated and experienced Academic Tutor with a proven track record for helping students to improve their academic performance. Adept at evaluating students and creating learning plans based on their strengths and weaknesses. Bringing forth a devotion to education and helping others to achieve their academic and life goals.

PERSONAL INFORMATION

Address: , ,

Nationality:

Driving License:

Hobbies: reading

SKILLS

????? Problem Solving Skills

????? Predictive Modeling

????? Customer Service Skills

????? Creative Problem Solving Skills

????? Strong Analytical Skills

????? Project Management Skills

????? Multitasking Skills

????? Leadership Skills

????? Curriculum Development

????? Excellent Communication Skills

????? SAT Prep

????? Knowledge of Educational Philosophies

????? Informal and Formal Assessments

0.00

0 Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2018 Essentials Of Taxation Individuals And Business Entities

ISBN: 9781337386173

21st Edition

Authors: William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

Question Posted:

Students also viewed these Business questions

-

During the year, Eugene had the four property transactions summarized below. Eugene is a collector of antique glassware and occasionally sells a piece to get funds to buy another. What are the amount...

-

Horst is a collector of hockey memorabilia. He is particularly interested in hockey sticks that have been autographed by well known players in the National Hockey League. When Horst checked on eBay,...

-

Eugene Company is a small private company that sells computers and provides consulting services. The owner of the company, Eugene, wants to expand and has asked you to become his business partner....

-

Identify a true statement about the rational and emotional aspects of leadership. Multiple choice question. Leadership is not about the rational or emotional sides of human experience Leadership...

-

The given functions all have limits of as x 0+. For each function, find how close the input must be to 0 for the output to be a) greater than 10, and b) greater than 100. Sketch a graph of each...

-

LO1,2 Based solely on the definitions in the chapter, is the Social Security tax a proportional, regressive, or progressive tax? Explain, and state how the tax might be viewed differently.

-

6. The stock price of XYZ is \($100\). One million shares of XYZ (a negligible fraction of the shares outstanding) are buried on a tiny, otherwise worthless plot of land in a vault that would cost...

-

For the given loading, determine the zero-force members in the truss shown.

-

Problem 3-7 Balance sheets for Prego Company and Sprague Company as of December 31, 2013, follow: Cash Accounts receivable (net) Inventory Property and equipment (net) Land Total assets Prego Company...

-

Jimmy owns a garden in which he has planted N trees in a row. After a few years, the trees have grown up and now they have different heights. Jimmy pays much attention to the aesthetics of his...

-

Ike, a single taxpayer, is reassigned for his job and must move to a new state. While searching for a place to live, he encounters a person who is selling her home in order to move to Ikes current...

-

Hilde purchased all of the rights to a patent on a new garden tool developed by a friend of hers who is an amateur inventor. The inventor obtained the patent rights, set up a manufacturing company to...

-

What is the basic decision rule in differential analysis? Explain each noun in the rule.

-

Vaporization of mixtures of hexane and octane. Using the T-x-y diagram (Figure 1) on the next page, determine the temperature, amounts, and compositions of the vapor and liquid phases at 1 atm for...

-

what should p&g do to replace lafley when he retires a second time? what actions should they take to prepare for the succession?

-

What do these terms mean? What would be the currencies (one at a time) from two total UN Member States (other than the EURO, USD, JPY, GBP, or CHF). What would be the foreign currencies and how they...

-

How do social identity processes, such as categorization, identification, and comparison, influence team cohesion and performance within complex organizational environments ?

-

How do calculate sales forecast and expense forecast for several years

-

What fields must be included in the ArrayIntList class, and why is each field important? Would the class still work correctly if we removed any of these fields?

-

Before the latest financial crisis and recession, when was the largest recession of the past 50 years, and what was the cumulative loss in output over the course of the slowdown?

-

Browse the internet sites oiseveml public accounting lirms and find discussions comparing stock purchases with asset purchases when acquiring :1 business. Based solely on your findings, prepare an...

-

Phil and Susan Hammond are married taxpayers filing a joint return. The couple have two dependent children. Susan has wages of $34,000 in 2017. Phil does not work due to a disability, but he is a...

-

Keshara has the following net ? 1231 results for each of the years shown. What would be the nature of the net gains in 2017 and 2018? Tax Year Net 1231 Loss Net 1231 Gain 2013 $18,000 2014 33,000...

-

Which of the following programs covers custodial care? A HMOs B Medicare Part B C PPOs D Medicare Part A E Medicaid

-

uppose a taxpayer has exhausted his lifetime exclusion amount and has $14 million. a. Assuming a flat 40% gift tax rate, what is the maximum amount a taxpayer can transfer to her daughter (and still...

-

Physical Units Method, Relative Sales Value Method Farleigh Petroleum, Inc., is a small company that acquires high - grade crude oil from low - volume production wells owned by individuals and small...

Study smarter with the SolutionInn App