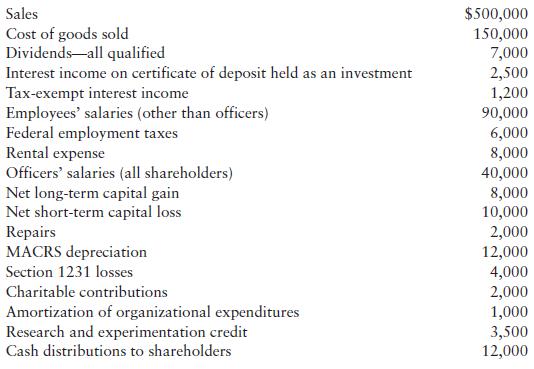

Eagle Corporation, an S corporation, reports the following items during 2021: Calculate ordinary income (or loss) by

Question:

Eagle Corporation, an S corporation, reports the following items during 2021:

Calculate ordinary income (or loss) by completing page 1 of Form 1120-S, and complete Schedule K (Shareholders’ Shares of Income, Credits, Deductions, etc.). Leave spaces blank on Form 1120-S if information is not provided.

Transcribed Image Text:

Sales Cost of goods sold Dividends all qualified Interest income on certificate of deposit held as an investment Tax-exempt interest income Employees' salaries (other than officers) Federal employment taxes Rental expense Officers' salaries (all shareholders) Net long-term capital gain Net short-term capital loss Repairs MACRS depreciation Section 1231 losses Charitable contributions Amortization of organizational expenditures Research and experimentation credit Cash distributions to shareholders $500,000 150,000 7,000 2,500 1,200 90,000 6,000 8,000 40,000 8,000 10,000 2,000 12,000 4,000 2,000 1,000 3,500 12,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 25% (4 reviews)

In order to calculate the ordinary income or loss for Eagle Corporation an S corporation well use the information provided to fill out the income and deductions on the US Income Tax Return for an S Co...View the full answer

Answered By

OTIENO OBADO

I have a vast experience in teaching, mentoring and tutoring. I handle student concerns diligently and my academic background is undeniably aesthetic

4.30+

3+ Reviews

10+ Question Solved

Related Book For

Pearsons Federal Taxation 2023 Individuals

ISBN: 9780137700127

36th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse

Question Posted:

Students also viewed these Business questions

-

Emily Jackson (Social Security number 765-12-4326) and James Stewart (Social Security number 466-74-9932) are partners in a partnership that owns and operates a barber shop. The partnership's first...

-

Eagle Corporation, an S corporation, reports the following items during 2015:...

-

The XYZ Partnership reports the following items during 2021: Calculate ordinary income (or loss) by completing page 1 of Form 1065, and complete Schedule K (Partners Shares of Income, Credits,...

-

Discuss why you would or would not like to work in an organization like this?

-

Describe the different types of orientation and training and how each of the types of training might be provided.

-

Do a bit more research on OHP. Choose an important element that is studied in that area (refer back to Table 11.2 for some examples). What expertise can I/O psychologists bring to the study of this...

-

Accountants usually define _________________ as a resource sacrificed or foregone to achieve a specific objective or something given up in exchange. a. money b. liability c. trade d. cost LO.1

-

Slopes Inc. manufactures and sells snowboards. Slopes manufacture a single model, the Pipex. In the summer of 2012, Slopess accountant gathered the following data to prepare budgets for 2013. These...

-

Boston Company is contemplating the purchase of a new machine on which the following information has been gathered: Cost of the machine Annual cash inflows expected Salvage value Life of the machine...

-

Five years ago, Abigail invested $400,000 for a 25% interest in Crab Tree Partnership. The partnership has incurred losses every year and by the beginning of this year, her outside basis in Crab Tree...

-

Steve and Erin started a general partnership to do landscaping and sell gardening supplies. Both will work in the business full time and need to withdraw approximately $40,000 a year each to live on....

-

Each year, NCAA college football fans like to learn about the size of the players in the current years recruit class. Following are the weights (in pounds) of the nations top 100 high school football...

-

Revenue and cash receipts journals; accounts receivable subsidiary and general ledgers Transactions related to revenue and cash receipts completed by Crowne Business Services Co. during the period...

-

Panguitch Company had sales for the year of $100,000. Expenses (except for income taxes) for the year totaled $80,000. Of this $80,000 in expenses, $10,000 is bad debt expense. The tax rules...

-

Assume that the composition of federal outlays and receipts shown in the figure remained the same in 2019. In the figure, the categories "Defense and homeland security" and "Non-defense...

-

1) A car's age is a _ variable. Quantitative O Categorical 2) A car's maker is a variable O Quantitative Categorical 3) A house's square footage is a _________variable O Quantitative O Categorical 4)...

-

The following table shows the distribution of clients by age limits. Use the grouped data formulas to calculate the variance and standard deviation of the ages. Rango de edad Cantidad de clientes...

-

Based on results from a Bradley Corporation poll, assume that 70% of adults always wash their hands after using a public restroom. a. Find the probability that among 8 randomly selected adults,...

-

Use the formula to determine the value of the indicated variable for the values given. Use a calculator when one is needed. When necessary, use the key on your calculator and round answers to the...

-

Consider the following information for Mr. and Mrs. Di Palma: On June 10, 2016, they sold their principal residence for $80,000 and incur $6,000 of selling expenses. The basis of the residence,...

-

Sherron, who is single, purchased a house to use as rental property on April 1, 2007, for $300,000. He moved into the house on June 1, 2016, and used it as a personal residence until August 1, 2017,...

-

Mr. and Mrs. Kitchens purchased their first home in Ohio for $135,000 on October 1, 2016. Because Mr. Kitchens employer transferred him to Utah, they sold the house for $160,000 on January 10, 2017....

-

Maddox Resources has credit sales of $ 1 8 0 , 0 0 0 yearly with credit terms of net 3 0 days, which is also the average collection period. Maddox does not offer a discount for early payment, so its...

-

Selk Steel Co., which began operations on January 4, 2017, had the following subsequent transactions and events in its long-term investments. 2017 Jan. 5 Selk purchased 50,000 shares (25% of total)...

-

Equipment with a book value of $84,000 and an original cost of $166,000 was sold at a loss of $36,000. Paid $100,000 cash for a new truck. Sold land costing $330,000 for $415,000 cash, yielding a...

Study smarter with the SolutionInn App