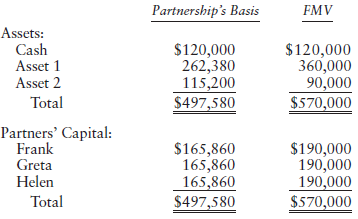

Frank, Greta, and Helen each have a one-third interest in the FGH Partnership. On December 31, 2016,

Question:

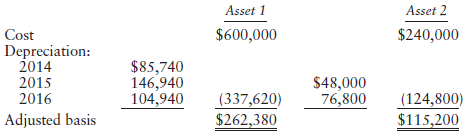

The partnership placed Asset 1 (seven-year property) in service in 2014 and Asset 2 (five-year property) in service in 2015. The partnership did not elect Sec. 179 expensing and elected out of bonus depreciation in both years. Accordingly, it computed the assets€™ adjusted bases at December 31, 2016 as follows:

At the end of business on December 31, 2016, Helen sold her partnership interest to Hank for $190,000. At the time of sale, the partnership had a Sec. 754 optional basis election in effect but has not elected to use the remedial method for allocating partnership items.

Required: The partners have asked you to determine (1) the amount and character of Helen€™s gain or loss; (2) Hank€™s optional basis adjustment and its allocation to Asset 1 and Asset 2; and (3) the amount of depreciation allocated to Hank in 2017, including the effects of the optional basis adjustment. At a minimum, you should consult the following resources:

€¢ IRC Secs. 743 and 751

€¢ Reg. Sec. 1.743-1(j)

€¢ Reg. Sec. 1.755-1

Step by Step Answer:

Federal Taxation 2018 Comprehensive

ISBN: 9780134532387

31st Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson