Latesha, a single taxpayer, had the following income and deductions for the tax year 2018: a. Compute

Question:

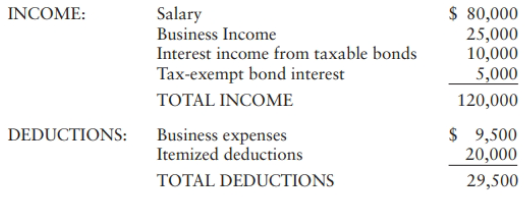

Latesha, a single taxpayer, had the following income and deductions for the tax year 2018:

a. Compute Latesha's taxable income and federal tax liability for 2018 (round to dollars).

b. Compute Latesha's marginal, average, and effective tax rates.

c. For tax planning purposes, which of the three rates in Part b is the most important?

Transcribed Image Text:

INCOME: $ 80,000 Salary Business Income Interest income from taxable bonds Tax-exempt bond interest 25,000 10,000 5,000 120,000 TOTAL INCOME DEDUCTIONS: $ 9,500 Business expenses Itemized deductions 20,000 TOTAL DEDUCTIONS 29,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (12 reviews)

a Income Salary Business income Interest income Deductio...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Federal Taxation 2019 Comprehensive

ISBN: 9780134833194

32nd Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

Brad and Angie had the following income and deductions during 2016: Salaries $110,000 Interest income $10,000 Itemized deductions $16,000 Taxes withheld during the year $15,000 Calculate Brad and...

-

Cindy had the following income and deductions listed on her 2020 individual income tax return. Business income $37,000 Interest income on personal investments $5,000 Less Business expenses $40,000...

-

You client, Rob, has the following income and deductions for the financial year ended 30 June 2018: salary, $32,000; bank interest received, $150; and allowable deductions for special work clothing,...

-

Given a circularly linked list L containing an even number of nodes, describe how to split L into two circularly linked lists of half the size.

-

Consider a portfolio position of $10 million on which returns are assumed to be normally distributed with a current standard deviation of 20 percent per annum. The average VAR on the previous 60 days...

-

In Problem 3-27, Farm Grown, Inc., has reason to believe the probabilities may not be reliable due to changing conditions. If these probabilities are ignored, what decision would be made using the...

-

Employee retentionwhat can we do to keep valued employees?

-

Brazilia Bus Tours has incurred the following bus maintenance costs during the recent tourist season. (The real is Brazils national monetary unit. On the day this exercise was written, the real was...

-

Dantzler Corporation is a fast-growing supplier of office products, Analysts project the following free cash flows (FCFS) durin the next 3 years, after which FCF is expected to grow at a constant 4%...

-

When air is released adiabatically from a tyre, the temperature of air at the nozzle exit is 37C below that of air inside the tyre. Neglecting irreversibility calculate the exit velocity of air.

-

Based on the amounts of taxable income below, compute the federal income tax payable in 2018 on each amount assuming the taxpayers are married filing a joint return. Also, for each amount of taxable...

-

The PDQ Partnership earned ordinary income of $150,000 in 2018. The partnership has three equal partners, Pete, Donald, and Quint. Quint, w ho is single, uses the standard deduction, and has other...

-

Jessel Corporation bases its variable overhead performance report on the actual direct labor-hours of the period. Data concerning the most recent year that ended on December 31 are as follows:...

-

Solve X+1U6x-13x+2-4x+5

-

Summarize the selected poster's design format, such as the color, layout, font style, size, space, and the subject's analysis format. Also, analyze how the study started. Such as background and...

-

Income statement Prior year Current year Revenues 782.6 900.0 Cost of sales Selling costs Depreciation (27.0) (31.3) Operating profit 90.4 85.7 Interest Earnings before taxes 85.4 78.2 Taxes (31.1)...

-

View the video at the slide title "Lab: Social Media Post" at time 28:20. Link:...

-

Write a program ranges.py in three parts. (Test after each added part.) This problem is not a graphics program. It is just a regular text program to illustrate your understanding of ranges and loops....

-

This problem is inspired by the single-player game Minesweeper, generalized to an arbitrary graph. Let G be an undirected graph, where each node either contains a single, hidden mine or is empty. The...

-

A line l passes through the points with coordinates (0, 5) and (6, 7). a. Find the gradient of the line. b. Find an equation of the line in the form ax + by + c = 0.

-

Andrea, who is in the 39.6% tax bracket, is interested in reducing her taxes. She is considering several alternatives. For each alternative listed below, indicate how much tax, if any, she would...

-

Bala and Ann purchased as investments three identical parcels of land over a several-year period. Two years ago they gave one parcel to their daughter, Kim, who is now age 16. They have an offer from...

-

Larry and Sue separated at the end of the year. Larry has asked Sue to sign a joint income tax return for the year because he feels that the tax will be lower on a joint return. Larry and Sue both...

-

In 2003, Sotheby's the auctioneer sold a mustang 1955 for a price of $10,341,500. The owner who sold the car had purchased the Mustang in 1999 at a price of $12,437,500 from a rich celebrity. What...

-

XYZ Corp is expected to grow earnings at 15% over the next few years. XYZs current P/E is 42 and their expected earnings per share next year is $3.00. Calculate the target price objective for XYZ.

-

$48.00 per share is the current price for Foster Farms' stock. The dividend is projected to increase at a constant rate of 5.50% per year. The required rate of return on the stock, rs, is 9.00%. What...

Study smarter with the SolutionInn App