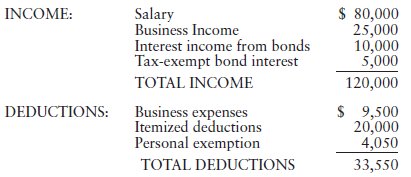

Latesha, a single taxpayer, had the following income and deductions for the tax year 2016: a. Compute

Question:

a. Compute Latesha€™s taxable income and federal tax liability for 2016 (round to dollars).

b. Compute Latesha€™s marginal, average, and effective tax rates.

c. For tax planning purposes, which of the three rates in Part b is the most important?

Transcribed Image Text:

$ 80,000 25,000 10,000 5,000 INCOME: Salary Business Income Interest income from bonds Tax-exempt bond interest TOTAL INCOME 120,000 $ 9,500 20,000 4,050 DEDUCTIONS: Business expenses Itemized deductions Personal exemption TOTAL DEDUCTIONS 33,550

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 78% (14 reviews)

a b Marginal rate 25 From tax rate schedule Average rate 1981 1613481450 ...View the full answer

Answered By

Akshay Singla

as a qualified engineering expert i am able to offer you my extensive knowledge with real solutions in regards to planning and practices in this field. i am able to assist you from the beginning of your projects, quizzes, exams, reports, etc. i provide detailed and accurate solutions.

i have solved many difficult problems and their results are extremely good and satisfactory.

i am an expert who can provide assistance in task of all topics from basic level to advance research level. i am working as a part time lecturer at university level in renowned institute. i usually design the coursework in my specified topics. i have an experience of more than 5 years in research.

i have been awarded with the state awards in doing research in the fields of science and technology.

recently i have built the prototype of a plane which is carefully made after analyzing all the laws and principles involved in flying and its function.

1. bachelor of technology in mechanical engineering from indian institute of technology (iit)

2. award of excellence in completing course in autocad, engineering drawing, report writing, etc

4.70+

48+ Reviews

56+ Question Solved

Related Book For

Federal Taxation 2017 Individuals

ISBN: 9780134420868

30th Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

If a single taxpayer had the following stock transactions, what is the amount that would be taxed at the favorable long-term capital gains tax rates? Net short-term gains $5,000 Net short-term losses...

-

Tax Rates. Latesha, a single taxpayer, had the following income and deductions for the tax year 2019: a. Compute Latesha's taxable income and federal tax liability for 2019 (round to dollars and...

-

Tax Rates. Lillian, a single taxpayer, had the following income and deductions for the tax year 2018: INCOME: Salary ....................................................$ 90,000 Business Income...

-

The people on Coral Island buy only juice and cloth. The CPI market basket contains the quantities bought in 2016. The average household spent $60 on juice and $30 on cloth in 2016 when the price of...

-

There are many ways to evaluate the effectiveness of an information system. Discuss each method and describe when one method would be preferred over another method.

-

What is a fixed-income security? The next three questions are based on the following table, where the interest rate is 4 percent per year, compounded once a year.

-

11. Suppose call and put prices are given by Strike 80 100 105 Call premium 22 9 5 Put premium 4 21 24.80 Find the convexity violations. What spread would you use to effect arbitrage? Demonstrate...

-

Ticotin Inc. is a retailer operating in British Columbia. Ticotin uses the perpetual inventory method. All sales returns from customers result in the goods being returned to inventory; the inventory...

-

The controller of Wildhorse Industries has collected the following monthly expense data for use in analyzing the cost behavior of maintenance costs Total Maintenance Costs Month Total Machine Hours...

-

Explain the following statements. a. A car exhaust pipe will rust much faster if the car is in constant use. b. Vegetables cook faster when they are chopped up. c. Industrial processes become more...

-

Betty, a married taxpayer, makes the following gifts during the current year (2016): $20,000 to her church, $50,000 to her daughter, and $40,000 to her husband. What is the amount of Bettys taxable...

-

Clay, who was single, died in 2016 and has a gross estate valued at $8,500,000. Six months after his death, the gross assets are valued at $9,000,000. The estate incurs funeral and administration...

-

Perpetuities Consider the data in the following table. Determine the present value of eachperpetuity. Perpetuity Annual amount Discount rate 20,000 100,000 3,000 60,000 8% 10

-

Complete the exercises on the following website. Remember to type your answers in word or excel, screenshot, or phone pic as your work. The site does not save your answers. Upload your work on...

-

There are many management theories that are utilized in organizations. These theories were developed by scholars in the management discipline. One individual was responsible for identifying the major...

-

An increase in the price and a decrease of the quantity of Paclitaxel (an anti-cancer drug) could be caused by which of the following? Select one: O a. an increase in the number of people being...

-

At December 31, 2023, Cord Company's plant asset and accumulated depreciation and amortization accounts had balances as follows: Category Land Land improvements Buildings Equipment Automobiles and...

-

Assume that the following table represents the sales figures for the five largest firms in the industry. Compute the HHI for the industry (assuming the industry contains just these five firms). Sales...

-

Determine whether each statement of a logarithmic property is true or false. If it is false, correct it by changing the right side of the equation. logo xy = log x + logb y

-

Which task is performed by a book-keeper? A. Analysing the trading results B. Entering transactions in the ledger C. Preparing year-end financial statements D. Providing information for...

-

Betty, a married taxpayer, makes the following gifts during the current year (2015): $20,000 to her church, $50,000 to her daughter, and $40,000 to her husband. What is the amount of Bettys taxable...

-

Clay, who was single, died in 2015 and has a gross estate valued at $8,500,000. Six months after his death, the gross assets are valued at $9,000,000. The estate incurs funeral and administration...

-

a. Keith Thomas and Thomas Brooks began a new consulting business on January 1, 2015. They organized the business as a C corporation, KT, Inc. During 2015, the corporation was successful and...

-

Slow Roll Drum Co. is evaluating the extension of credit to a new group of customers. Although these customers will provide $198,000 in additional credit sales, 13 percent are likely to be...

-

Wendell's Donut Shoppe is investigating the purchase of a new $39,600 conut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings...

-

1.Discuss the challenges faced with Valuing Stocks and Bonds. As part of this discussion, how will the selected item be implemented in an organization and its significance? 2. Discuss how Valuing...

Study smarter with the SolutionInn App