Marion Mosley created the Jenny Justice Trust in 2005 with First Bank named as trustee. For 20

Question:

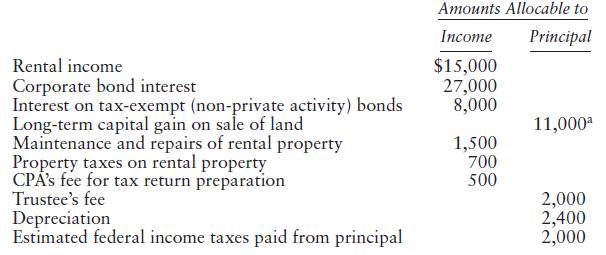

Marion Mosley created the Jenny Justice Trust in 2005 with First Bank named as trustee. For 20 years, the trust is to pay out all its income semiannually to the beneficiary, Jenny Justice. At the end of the twentieth year, the trust assets are to be distributed to Jenny?s descendants. According to the trust instrument, capital gains are credited to principal, and depreciation is charged to principal. For the current year, the irrevocable trust reports the following results:

Prepare a Form 1041, including any needed Schedule K-1s, for the Jenny Justice Trust. Ignore the alternative minimum tax (AMT). The trustee?s address is P.O. Box 100, Southwest City, TX 75000. The identification number of the trust is 74-1234567. Jenny, resides at 2 Mountain View, South City, AL 35000.

Amounts Allocable to Income Principal Rental income Corporate bond interest Interest on tax-exempt (non-private activity) bonds Long-term capital gain on sale of land Maintenance and repairs of rental property Property taxes on rental property CPÅ's fee for tax return preparation Trustee's fee $15,000 27,000 8,000 11,000 1,500 700 500 Depreciation Estimated federal income taxes paid from principal 2,000 2,400 2,000

Step by Step Answer:

To prepare the form you need some additional information from the image Rental income The amount sho...View the full answer

Federal Taxation 2018 Comprehensive

ISBN: 9780134532387

31st Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Students also viewed these Business questions

-

Bonnie died on June 1, 2014, survived by her husband, Abner, and two sons, Carl and Doug. Bonnie's only lifetime taxable gift was made in October 2013 in the taxable amount of $6.25 million. She did...

-

Bonnie died on June 1, 2013, survived by her husband, Abner, and two sons, Carl and Doug. Bonnie's only lifetime taxable gift was made in October 2010 in the taxable amount of $1.25 million. She did...

-

Assume the same facts as in Problem 13-57 except the joint tenancy land was held in the names of Bonnie and her son Doug, joint tenants with right of survivorship. Also assume that Bonnie provided...

-

Montage Pty Limited (Montage) is a resident private company and is not a base rate entity. Which of the following transactions would result in a debit entry to Montage's franking account? Payment of...

-

Write chemical equations, showing all necessary reagents, for the preparation of 1-butanol by each of the following methods: (a) Hydroboration-oxidation of an alkene (b) Use of a Grignard reagent (c)...

-

Suppose the Federal Aviation Administration would like to compare the on-time performances of different airlines on domestic, nonstop flights. The following table shows three different airlines and...

-

What two basic conditions can lead to conflicts between the NPV and IRR methods? AppendixLO1

-

FIFO method, equivalent units. Refer to the information in Exercise 17-19. Suppose the Assembly Division at Fenton Watches, Inc., uses the FIFD method of process costing instead of the...

-

Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. A partnership does not pay tax on its income but "passes through" any profits or losses to its...

-

Profits have been decreasing for several years at Pegasus Airlines. In an effort to improve the company?s performance, consideration is being given to dropping several flights that appear to be...

-

In 2014, Leon Lopez funded Lopez Trust #3, an irrevocable trust, at First Bank, 125 Seaview, Northwest City, WA 98112, for the benefit of his twin children, Loretta and Jorge. The trust?s tax ID...

-

Prepare an estate tax return (Form 706) for Adam Zugg of 45 Cornfield Place, Midwest City, IL 60000. Adam died October 31, 2016. He was survived by his wife, Callie, and their son, Zebulon. At the...

-

Caleb Samford calls you and says that his two-person S corporation was involuntarily terminated in February 2018. He asks you if they can make a new S election now, in November 2019. Draft a memo for...

-

A company determines that monthly sales S(t), in thousands of dollars, after t months of marketing a product is given by S(t) = 23-551 + 230t+ 160. a) Find S'(1), S'(2), and S'(4). b) Find S''(1),...

-

Dan is a 16 year-old who decided to skip his adolescent development class. If Dan was 19 years-old, this would be his choice, but because of his age, he has broken the law. What type of offence did...

-

You need to remove a bolt from a metal door. The maximum torque the bolt can withstand before starting to rotate is 7 = 70 N-m. You apply a wrench of m = 0.5 kg and 1 = 0.3 m long. You push down on...

-

Lesson 10.1: Emotional Intelligence Emotional Intelligence is a type of social intelligence that affords the individual the ability to monitor his own and others' emotions, to discriminate among...

-

Harriet??s annuity has a total cash value of $2000, and she has paid a total of $1,500 into it. Under a Section 1035 exchange, Harriet rolls the entire value of the annuity into a different annuity....

-

Why is managing returns important?

-

Four GWU students have been selected to taste food sold by 3 different food trucks labeled as food truck A, B and C on H & 22nd Streets every Monday for 3-weeks. For each student, food trucks are...

-

Gaylord Gunnison (GG) died January 13, 2014, and his gross estate consisted of three properties-cash, land, and stock in a public company. The amount of cash on the date of his death was $2.9...

-

Matt Patterson died in early 2014 with a $4.5 million gross estate and no deductions other than a potential marital deduction. He bequeathed all his property to his spouse, Nancy, with the provision...

-

In 2008, Jack purchased undeveloped oil and gas property for $900,000 and paid $170,000 for intangible drilling and development costs. He elected to expense the intangible drilling and development...

-

Q 3: (A): How State Bank of Pakistan (SBP) is playing its role in development of Pakistan? What are the major steps taken by SBP in this regard? (B): Due to the economic deterioration in rural areas,...

-

true- false statement (d) Private firms smooth dividends to satisfy shareholders' consumption preferences

-

Abc. Co. has one employee who earns $500 per week and is paid every Monday for the previous week worked. December 31st is a Wednesday. Your employee works Monday-Friday. a. Record the required...

Study smarter with the SolutionInn App