Mike and Linda are a married couple who file jointly. They have three dependent children who are

Question:

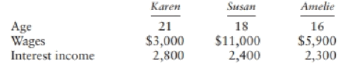

Mike and Linda are a married couple who file jointly. They have three dependent children who are full-time students in 2019. Mike and Linda provided $8,000 of support for each child. Information for each child is as fol lows:

Compute each child's tax, assuming the interest income is taxable.

Transcribed Image Text:

Karen Susan Amelie Age Wages Interest income 21 18 16 $3,000 2,800 $11,000 2,400 $5,900 2,300

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 57% (7 reviews)

Karen Karens gross tax is 245At age 21 Karen is subject to the kiddie tax because she is a fulltime ...View the full answer

Answered By

Aysha Ali

my name is ayesha ali. i have done my matriculation in science topics with a+ . then i got admission in the field of computer science and technology in punjab college, lahore. i have passed my final examination of college with a+ also. after that, i got admission in the biggest university of pakistan which is university of the punjab. i am studying business and information technology in my university. i always stand first in my class. i am very brilliant client. my experts always appreciate my work. my projects are very popular in my university because i always complete my work with extreme devotion. i have a great knowledge about all major science topics. science topics always remain my favorite topics. i am also a home expert. i teach many clients at my home ranging from pre-school level to university level. my clients always show excellent result. i am expert in writing essays, reports, speeches, researches and all type of projects. i also have a vast knowledge about business, marketing, cost accounting and finance. i am also expert in making presentations on powerpoint and microsoft word. if you need any sort of help in any topic, please dont hesitate to consult with me. i will provide you the best work at a very reasonable price. i am quality oriented and i have 5 year experience in the following field.

matriculation in science topics; inter in computer science; bachelors in business and information technology

_embed src=http://www.clocklink.com/clocks/0018-orange.swf?timezone=usa_albany& width=200 height=200 wmode=transparent type=application/x-shockwave-flash_

4.40+

11+ Reviews

14+ Question Solved

Related Book For

Federal Taxation 2020 Comprehensive

ISBN: 9780135196274

33rd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

Question Posted:

Students also viewed these Business questions

-

Joe and Jane Keller are a married couple who file a joint income tax return. The couple's taxable income was $102,000. How much federal taxes did they owe? Use the tax tables given in the chapter.

-

Joe and Jane Keller are a married couple who file a joint income tax return, where the tax rates are based on the tax tables presented in the chapter. Assume that their taxable income this year was...

-

Susan and Stan Britton are a married couple who file a joint income tax return, where the tax rates are based on the tax tables presented in the chapter. Assume that their taxable income this year...

-

Steel It began January with 55 units of iron inventory that cost $35 each. During January, the company completed the following inventory transactions: Requirements 1. Prepare a perpetual inventory...

-

Mercury is often used in barometers as depicted in Figure P2.2.3. This is because the vapor pressure of mercury is low enough to be ignored, and because it is so dense (sp. gr. = 13. 6) the tube can...

-

Why is continual user involvement a useful way to discover system requirements? Under what conditions might it be used? Under what conditions might it not be used?

-

How will you show salaries outstanding in final accounts if it appears in the Trial Balance?

-

Sallys Software Inc. is a rapidly growing supplier of computer software to the Sarasota area. Sales for the last 5 years, 2009 to 2013, are given below. Sales Year ($ millions) 2009 .........1.1 2010...

-

Problem 3-12 (Static) Predetermined Overhead Rate; Disposing of Underapplied or Overapplied Overhead [LO3-4] Luzadis Company makes furniture using the latest automated technology. The company uses a...

-

Martha has not made any taxable gifts in her past Check and complete the excel spreadsheet of total assets. ASSUME BENNY DIES ON DECEMBER 31, 2020. Prepare a Reconciliation of Gross Estate to the...

-

Lucy is 17 years old and a dependent of her parents. She receives $9,000 of wages from a pan-time job and $10,400 of taxable interest from bonds she inherited. Determine Lucy's taxable income and tax.

-

Virginia is a cash-basis, calendar-year taxpayer. Her salary is $90,000, and she is single. She plans to purchase a residence in 2020. She anticipates her property taxes and interest will total...

-

To construct a solenoid having cross-sectional area \(1.256 \times 10^{-3} \mathrm{~m}^{2}\) and 500 windings that can produce a magnetic field of \(10 \times 10^{-3} \mathrm{~T},\) (a) calculate the...

-

Hammond Inc. experienced the following transactions for 2011, its first year of operations: 1. Issued common stock for \(\$ 80,000\) cash. CHECK FIGURES b. Net Income: \(\$ 62,520\) Total Assets:...

-

Following are the current prices and last years prices of a gallon of regular gas at a sample of 14 gas stations. Can you conclude that the median price is different now from what it was a year ago?...

-

A sample of nine men participated in a regular exercise program at a local gym. They were weighed both before and after the program. The results were as follows. Can you conclude that the median...

-

Pink Jeep Tours offers off-road tours to individuals and groups visiting the Southwestern U.S. hotspots of Sedona, Arizona, and Las Vegas, Nevada. Take a tour of the companys Web site at...

-

The following are unrelated accounting practices: 1. Pine Company purchased a new \(\$ 30\) snow shovel that is expected to last six years. The shovel is used to clear the firm's front steps during...

-

Which of the following assignment statements will not calculate correctly? a. lblTotal.Text = Val(txtSales1.Text) + Val(txtSales2.Text) b. lblTotal.Text = 4 Val(txtSales1.Text) c. lblTotal.Text =...

-

What tools are available to help shoppers compare prices, features, and values and check other shoppers opinions?

-

Refer to the facts in Problem C:3-60. Assume that Omega Corporations employer identification number is XX-1234321 and that Omegas income statement is unaudited and non-tax based (it is GAAP based)....

-

Refer to the facts in Problem C:3-58, and prepare Form 1120, Schedule M-1 based on these facts.

-

Permtemp Corporation (EIN: XX-1234567) formed in 2018 and, for that year, reported the following book income statement and balance sheet, excluding the federal income tax expense, deferred tax...

-

Investor A owns 10% of the common stock of IDE Corporation. After IDE completes a 2-for-1 stock split, Investor A will own 20% of the common stock of the corporation. 1) True 2) False

-

A loan is amortized over 7 years, with monthly payments at a nominal rate of 7.1% compounded monthly. The first payment is $1000, paid one month from the date of the loan. Each succeeding monthly...

-

How to you find the purchase of raw materials

Study smarter with the SolutionInn App