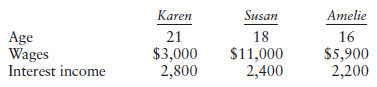

Mike and Linda are a married couple who file jointly. They have three dependent children who are

Question:

Compute each child€™s tax.

Transcribed Image Text:

Karen 21 $3,000 2,800 Susan Amelie 16 Age Wages Interest income 18 $11,000 $5,900 2,200 2,400

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 90% (11 reviews)

Karen Karens gross tax is 371 At age 21 Karen is subject to the kiddie tax because she is a fulltime student who earned less than onehalf of her own s...View the full answer

Answered By

Pushpinder Singh

Currently, I am PhD scholar with Indian Statistical problem, working in applied statistics and real life data problems. I have done several projects in Statistics especially Time Series data analysis, Regression Techniques.

I am Master in Statistics from Indian Institute of Technology, Kanpur.

I have been teaching students for various University entrance exams and passing grades in Graduation and Post-Graduation.I have expertise in solving problems in Statistics for more than 2 years now.I am a subject expert in Statistics with Assignmentpedia.com.

4.40+

3+ Reviews

10+ Question Solved

Related Book For

Federal Taxation 2017 Individuals

ISBN: 9780134420868

30th Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

Susan and Stan Britton are a married couple who file a joint income tax return, where the tax rates are based on the tax table 3.5. Assume that their taxable income this year was $309,000. Round your...

-

Joe and Jane Keller are a married couple who file a joint income tax return. The couple's taxable income was $102,000. How much federal taxes did they owe? Use the tax tables given in the chapter.

-

Joe and Jane Keller are a married couple who file a joint income tax return, where the tax rates are based on the tax tables presented in the chapter. Assume that their taxable income this year was...

-

The following scatter plot indicates that 200 150 > 100 50 0 0 20 X 40 O a log x transform may be useful Oa y transform may be useful a x transform may be useful Ono transform is needed Oa 1/x...

-

What is reengineering? What are the potential benefits of performing a process redesign?

-

Jiminy Jacks produces jacks that are used in many types of automobiles. In the assembly department, materials are added at the beginning of the process and conversion costs are added evenly during...

-

5. Obtain at least 5 years of daily data for at least three stocks and, if you can, one currency. Estimate annual volatility for each year for each asset in your data. What do you observe about the...

-

The data in Table 9E.3 are temperature readings from a chemical process in ï°C, taken every two minutes. (Read the observations down, from left.) The target value for the mean is...

-

1) In general, negotiated transfer prices will fall in a range between the selling division's relevant costs and the market price the buying division would need to pay if they were buying externally....

-

In his analysis of Californias Proposition 103 (see Illustration 4.2), Benjamin Zycher notes that one of the most important provisions of this proposition is eliminating the practice by insurance...

-

In 2016, Lana, a single taxpayer with AGI of $85,400, claims exemptions for three dependent children, all under age 17. What is the amount of her child credit?

-

Matt and Sandy reside in a community property state. Matt left home in April 2016 because of disputes with his wife, Sandy. Subsequently, Matt earned $15,000. Before leaving home in April, Matt...

-

You are in a boat 2 miles from the nearest point on the coast (see figure). You plan to travel to point Q, 3 miles down the coast and 1 mile inland. You row at 2 miles per hour and walk at 4 miles...

-

How would you explain the following code in plain English? boxplot(age ~ gender, data = donors) Question 8 options: Make a boxplot comparing gender grouped by age, using the donors dataset Make two...

-

Vision Consulting Inc. began operations on January 1, 2019. Its adjusted trial balance at December 31, 2020 and 2021 is shown below. Other information regarding Vision Consulting Inc. and its...

-

A Jeans maker is designing a new line of jeans called Slams. Slams will sell for $290 per unit and cost $182.70 per unit In variable costs to make. Fixed costs total $68,500. (Round your answers to 2...

-

NAME: Week Two Define Claim in your own words Explain the difference between a discussion and an argument. Summarize the characteristics of a claim (Listing is not summarizing) Define Status Quo in...

-

1.How do you think major stores such as Walmart will change in the future under this new retail renaissance? 2.What are some changes that you would suggest in traditional retail stores to attract...

-

Determine whether each statement of a logarithmic property is true or false. If it is false, correct it by changing the right side of the equation. log, b = r

-

In Problem use absolute value on a graphing calculator to find the area between the curve and the x axis over the given interval. Find answers to two decimal places. y = x 3 ln x; 0.1 x 3.1

-

Wes and Tina are a married couple and provide financial assistance to several persons during the current year. For the situations below, determinewhether the individuals qualify as Wes and Tinas...

-

John and Carole file a joint return and have three children: Jack, age 23; David, age 20; and Kristen, age 15. All three children live at home the entire year. Below is information about each of the...

-

Robert provides much of the support for his daughter, Jane, and her two children. Jane earned $20,000. Robert, whose AGI is $350,000, paid the rent of $11,000 on Janes apartment and provided an...

-

1,600 Balance Sheet The following is a list (in random order) of KIP International Products Company's December 31, 2019, balance sheet accounts: Additional Paid-In Capital on Preferred Stock $2,000...

-

Question 3 4 pts 9 x + 3 x 9 if x 0 Find a) lim f(x), b) lim, f(x), C), lim , f(x) if they exist. 3 Edit View Insert Format Tools Table : 12pt M Paragraph B IV A2 Tv

-

Mr. Geoffrey Guo had a variety of transactions during the 2019 year. Determine the total taxable capital gains included in Mr. Guo's division B income. The transactions included: 1. On January 1,...

Study smarter with the SolutionInn App