Mike Webb, married to Nancy Webb, is employed by a large pharmaceutical company and earns a salary.

Question:

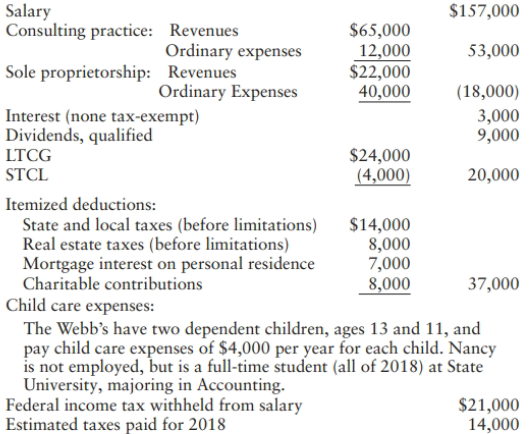

Mike Webb, married to Nancy Webb, is employed by a large pharmaceutical company and earns a salary. In addition, Mike is an entrepreneur and has two small businesses on the side, both of which operate as sole proprietorships. One is a profitable consulting business where Mike provides financial and retirement advice to pharmacists. The other involves the manufacture of Christmas novelties in China, selling the products in gift shops in the U.S. This business is struggling. However, Mike fee ls the Christmas novelty business has great potential. Mike reports the following for 2018:

For 2017, Mike and Nancy's AGI was $175,000 and their actual federal income tax liability was $29,000.

a. Compute the Webbs regular federal income tax liability for 2018, including self-employment taxes.

b. Are the Webbs subject to AMT in 2018, assuming they have additional AMT preferences of $70,000?

c. Are the Webbs due a refund for 2018?

d. Are the Webbs subject to any underpayment penalties for 2018?

Step by Step Answer:

Federal Taxation 2019 Comprehensive

ISBN: 9780134833194

32nd Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson