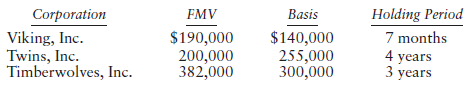

On December 20 of the current year, Winneld has decided to sell all of the stock that

Question:

She is willing to sell some of the stock this year and the remaining stock next year if it is more advantageous to spread the sales over two years. Assume that the FMV of the stock will not change during the next 30 days, and ignore the effect of a sale on threshold amounts. Determine the increase in her income tax for each of the following alternatives (a, b, & c) and advise Winneld.

She is willing to sell some of the stock this year and the remaining stock next year if it is more advantageous to spread the sales over two years. Assume that the FMV of the stock will not change during the next 30 days, and ignore the effect of a sale on threshold amounts. Determine the increase in her income tax for each of the following alternatives (a, b, & c) and advise Winneld.a. Sell all stock this year.

b. Sell Twins and Timberwolves this year and Viking in March of next year.

c. Sell Viking and Twins this year and Timberwolves in March of next year.

d. Determine her Medicare tax on net investment income in Part a if she has no investment income before selling all the stock. Stocks

Stocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2018 Comprehensive

ISBN: 9780134532387

31st Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted: