Passive Losses. In 2018, Mark purchased two separate activities. Information regarding these activities for 2018 and 2019

Question:

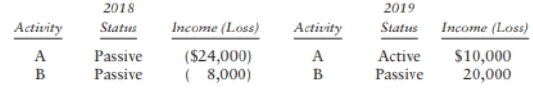

Passive Losses. In 2018, Mark purchased two separate activities. Information regarding these activities for 2018 and 2019 is as follows:

The 2018 losses were suspended losses for that year. During 2019, Mark also reports salary income of $120,000 and interest and dividend income of $20,000. Compute the amount (if any) of losses attributable to Activities A and B that are deductible in 2019 and any suspended losses carried to 2020.

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2020 Comprehensive

ISBN: 9780135196274

33rd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

Question Posted: