Phil, a cash-basis taxpayer, sells the following marketable securities, which are capital assets during 2019. Determine whether

Question:

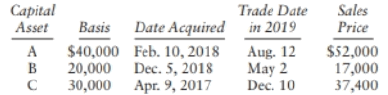

Phil, a cash-basis taxpayer, sells the following marketable securities, which are capital assets during 2019. Determine whether the gains or losses are long-term or short term. Also deter? mine the net capital gain and adjusted net capital gain for 2019.

Transcribed Image Text:

Саpital Asset Trade Date Sales Price Basis Date Acquired in 2019 $40,000 Feb. 10, 2018 20,000 Dec. 5, 2018 30,000 Aug. 12 $52,000 17,000 37,400 A May 2 Dec. 10 B C Apr. 9, 2017

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

The gain on the sale of A is a LTCG of 12000 the loss on the sa...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Federal Taxation 2020 Comprehensive

ISBN: 9780135196274

33rd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

Question Posted:

Students also viewed these Business questions

-

Answer with either True or False and then provide at most three sentences, which includes an explanation with empirical and/or theoretical backing to support your answer. A) An increase in the...

-

Is there a difference between a cash basis taxpayer and an accrual taxpayer regarding allowing a bad debt deduction?

-

Yolanda is a cash basis taxpayer with the following transactions during the year: Cash received from sales of products........... $65,000 Cash paid for expenses (except rent and interest)..........

-

In early 2015, the employment-population ratio was increasing while the labor force participation rate remained largely unchanged. Shouldn't both of these data series move in the same direction?...

-

The pressure inside a droplet of water is greater than the pressure outside. Split a droplet in half and identify forces. The bursting force is the pressure difference times the area that is balanced...

-

What is BPMN? Who is responsible for it?

-

What do you mean by Final Accounts with adjustments?

-

Leonard Presbys newsstand uses naive forecasting to order tomorrows papers. The number of newspapers ordered corresponds to the previous days demands. Todays demand for papers was 22. Presby buys the...

-

Common Stuck is considered a hybrid security between preferred stock and bonds Trus False

-

Question 1 Surrey Furniture Ltd is a UK company that manufactures two types of office desks, named basic (Product A) and deluxe (Product B). The production data for the two products are shown in the...

-

ln 2009, Ellen purchased a house for $ 150,000 to use as her personal residence. She paid 530,000 and borrowed S 120,000 from the local savings and loan company. In 201 I she paid $20,000 to add a...

-

Sylvia, a dentist with excellent skills as a carpenter, started the construction of a house that she planned to give to her son as a surprise when he returned from Afghanistan, where he is serving in...

-

A sample of an isotope for which = 0.10 s 1 contains 5.0 10 9 undecayed nuclei at the start of an experiment. Determine: a. The number of undecayed nuclei after 50 s b. Its activity after 50 s.

-

On March 6, 2011, Bob's Imports purchased merchandise from Watches Inc. with a list price of \(\$ 31,000\), terms \(2 / 10, n / 45\). On March 10, Bob's returned merchandise to Watches Inc. for...

-

The following events apply to Tops Gift Shop for 2012, its first year of operation: 1. Acquired \(\$ 45,000\) cash from the issue of common stock. 2. Issued common stock to Kayla Taylor, one of the...

-

Indicate whether each of the following costs is a product cost or a period (selling and administrative) cost. a. Transportation-in. b. Insurance on the office building. c. Office supplies. d. Costs...

-

Refer to the information presented in M7-9. Suppose that Juanita has developed a rectangular, medium-size ceramic pot. It requires 3 hours of kiln time; however, two medium-size pots can fit m the...

-

Eclipse Company manufactures a variety of sunglasses. Production information for its most popular line, the Total Eclipse (TE), follows: Suppose that Eclipse has been approached about making a...

-

In this exercise, you will create a splash screen that has a transparent background. a. Open the VB2015\Chap01\Transparency Solution\Transparency Solution (Transparency Solution.sln) file. If...

-

You are the newly appointed tax practitioner to complete Emilys tax return and have downloaded the prefill report for Emilys tax return (hint, you can read what a prefill report is here (Links to an...

-

Voyles Corporation, a calendar year taxpayer formed five years ago, desires to make an S election beginning in 2021. Sue and Andrea each own one-half of the Voyles stock. a. How does Voyles make the...

-

Orlando Corporation, a calendar year taxpayer, has been an S corporation for several years. On July 9, 2020, Orlando authorizes a second class of nonvoting preferred stock that pays a 10% annual...

-

Tango Corporation, a calendar year taxpayer, has been an S corporation for several years. Tangos business activities have become very profitable in recent years. On June 16, 2020, its sole...

-

Complete Case 9-45 Case 9-45 should be prepared in a Word document with embedded Excel spreadsheets for relevant calculations and supporting schedules. You still need to post your Excel worksheet to...

-

According to Barth, Caprio, and Levine, regulators ought to think of ways of helping financial markets, particularly bank debt and equity holders, to monitor banks. 1) True 2) False VE

-

Suppose you see that a stock has a very high Price-to-earnings (P/E) ratio. Does it imply that this stock is overvalued? Why or why not? Explain

Study smarter with the SolutionInn App