Stan Bushart works as a customer representative for a large corporation. Stans job entails traveling to meet

Question:

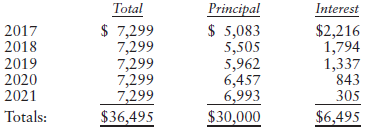

If he leases the car, his lease payment will be $450 per month for 60 months. At the end of the lease, he has the option of purchasing the car for $10,000. For simplicity, assume an average lease inclusion amount of $230 per year rather than actual amounts. Stan€™s marginal tax rate is 28% in each of the five years. Using present value analysis with an 8% discount rate, is Stan better off leasing or buying the car?

If Stan purchases the car, he will not claim Sec. 179 expensing or bonus depreciation. He will sell the car for $10,000 at the end of five years. If he leases the car, assume he merely turns the car in at the end of the lease.

Step by Step Answer:

Federal Taxation 2018 Comprehensive

ISBN: 9780134532387

31st Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson