Tampa Corporation sold the following assets in 2019: a. What is the depreciation deduction for each asset

Question:

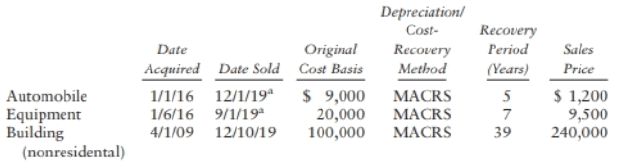

Tampa Corporation sold the following assets in 2019:

a. What is the depreciation deduction for each asset in 2019?

b. Compute the gain or loss on each asset sold.

Transcribed Image Text:

Automobile Equipment Building (nonresidental) Date Acquired Date Sold 1/1/16 12/1/19ª 1/6/16 9/1/19ª Original Cost Basis $ 9,000 20,000 4/1/09 12/10/19 100,000 Depreciation/ Cost- Recovery Method MACRS MACRS MACRS Recovery Period (Years) 5 7 39 Sales Price $ 1,200 9,500 240,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 30% (10 reviews)

a The depreciation deduction for each asset in 20...View the full answer

Answered By

DHRUV RAI

As a tutor, I have a strong hands-on experience in providing individualized instruction and support to students of all ages and ability levels. I have worked with students in both one-on-one and group settings, and I am skilled in creating engaging and effective lesson plans that meet the unique needs of each student.

I am proficient in using a variety of teaching techniques and approaches, including problem-based learning, inquiry-based learning, and project-based learning. I also have experience in using technology, such as online learning platforms and educational software, to enhance the learning experience for my students.

In addition to my teaching experience, I have also completed advanced coursework in the subjects that I tutor, including mathematics, science, and language arts. This has allowed me to stay up-to-date on the latest educational trends and best practices, and to provide my students with the most current and effective teaching methods.

Overall, my hands-on experience and proficiency as a tutor have equipped me with the knowledge, skills, and expertise to help students achieve their academic goals and succeed in their studies.

0.00

0 Reviews

10+ Question Solved

Related Book For

Federal Taxation 2020 Comprehensive

ISBN: 9780135196274

33rd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

Question Posted:

Students also viewed these Business questions

-

Tampa Corporation sold the following assets in 2015: a. What is the depreciation deduction for each asset in 2015? b. Compute the gain or loss on each asset sold. Date Date Original Cost...

-

Tampa Corporation sold the following assets in 2012: a. What is the depreciation deduction for each asset in 2013? b. Compute the gain or loss on each asset sold. OriginalDepreciation Recovery Date...

-

Tampa Corporation sold the following assets in 2016: a The half-year convention was used in the year of acquisition. Tampa did not claim Sec. 179 expense or bonus depreciation during the acquisition...

-

why people who are sophisticated but face borrowing constraint would increase consumption when they receive transfer payment?

-

Explain the difference between a contract that is performed illegally and an illegal contract.

-

Seventy-five percent of female prison inmates are mothers. If 3 female prison inmates are selected at random, what is the probability that none are mothers?

-

Can you tell us a little about your main day-to-day communication activities? What does your average nine-to-five day at COS look like? LO.1

-

Petal Providers Corporation, described in Problem 5, is interested in estimating its sustainable sales growth rate. Last year, revenues were $1 million; net profit was $50,000; investment in assets...

-

Section 1 Compulsory (25 marks) 1. One of the major strengths of the survey research design is its high external validity. Using an example, discuss the relevance of this statement. In answering this...

-

On January 1, 2021, DC Ltd. issued bonds with a maturity value of $8 million when the market rate of interest was 4%. The bonds have a coupon (contractual) interest rate of 5% and mature on January...

-

Stan Bushart works as a customer representative for a large corporation. Stan's job entails traveling to meet with customers, and he uses his personal car 100% for business use. In 2019, Stan must...

-

Turner Corporation uses the calendar year as its tax year. It purchases and places into service $1.97 million of property during 2019 to use in its business: What is Turner's total depreciation...

-

Could a habitat that received regular, but not extreme, disturbances be more diverse than one that received no disturbances? How would it compare to a habitat that received regular, extreme...

-

Find the unknown angle measures. 49 60 Drawing is not to scale. I = y = In S

-

Q5 For this question, use data from only restaurants with between 50 and 60 items in the data set. Predict total fat from cholesterol, total carbs, vitamin a, and restaurant. Remove any...

-

A meteorologist believes that there is a relationship between the daily mean windspeed, w kn, and the daily mean temperature, t C. A random sample of 9 consecutive days is taken from past records...

-

Suppose k(x) = f(g(h(x))). Given the table of values below, determine k' (1). g(x) h(x) f'(x) g'(x) h'(x) x f(x) 1 -6 -3 3 6 -6 -6 3 -3 4 1 -7 -2 5 4 -2 7 3 1 -7 -8

-

In a research study women with metastatic stomach cancer responded to the Symptom Distress Scale and the Profile of Mood States. A correlation coefficient was reported: r = 0.5, p = 0.03. How would...

-

Find an equation for the hyperbola described. Graph the equation. Center at (3, 7); focus at (7, 7); vertex at (6, 7)

-

Determine the volume of the parallelepiped of Fig. 3.25 when (a) P = 4i 3j + 2k, Q = 2i 5j + k, and S = 7i + j k, (b) P = 5i j + 6k, Q = 2i + 3j + k, and S = 3i 2j + 4k. P

-

Leonard's home was damaged by a fire. He also had to be absent from work for several days to make his home habitable. Leonard's employer paid Leonard his regular salary, $2,500, while he was absent...

-

The Sage Company has the opportunity to purchase a building located next to its office. Sage would use the building as a day care center for the children of its employees and an exercise facility for...

-

Andrea entered into a 529 qualified tuition program for the benefit of her daughter, Joanna. Andrea contributed $15,000 to the fund. The fund balance had accumulated to $25,000 by the time Joanna...

-

Problem 1 5 - 5 ( Algo ) Lessee; operating lease; advance payment; leasehold improvement [ L 0 1 5 - 4 ] On January 1 , 2 0 2 4 , Winn Heat Transfer leased office space under a three - year operating...

-

Zafra and Stephanie formed an equal profit- sharing O&S Partnership during the current year, with Zafra contributing $100,000 in cash and Stephanie contributing land (basis of $60,000, fair market...

-

What is the Breakeven Point in units assuming a product selling price is $100, Fixed Costs are $8,000, Variable Costs are $20, and Operating Income is $32,000 ? 100 units 300 units 400 units 500 units

Study smarter with the SolutionInn App