The following facts pertain to Lifecycle Corporation: ¢ Able owns a parcel of land (Land A) having

Question:

€¢ Able owns a parcel of land (Land A) having a $30,000 FMV and $16,000 adjusted basis. Baker owns an adjacent parcel of land (Land B) having a $20,000 FMV and $22,000 adjusted basis. On January 2, 2017, Able and Baker contribute their parcels of land to newly formed Lifecycle Corporation in exchange for 60% of the corporation€™s stock for Able and 40% of the corporation€™s stock for Baker. The corporation elects a calendar tax year and the accrual method of accounting.

€¢ On January 2, 2017, the corporation borrows $2 million and uses the loan proceeds to build a factory ($1 million), purchase equipment ($500,000), produce inventory ($450,000), pay other operating expenses ($30,000), and retain working cash ($20,000). Assume the corporation sells all inventory produced and collects on all sales immediately so that, at the end of any year, the corporation has no accounts receivable or inventory balances.

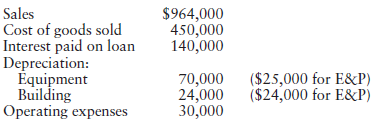

€¢ Operating results for 2017 are as follows:

Of these amounts, $250,000 is qualified production activities income. The deduction percentage is 9%.

€¢ In 2018, Lifecycle Corporation invests $10,000 of excess cash in Macro Corporation stock (less than 20% owned) and $20,000 in tax-exempt bonds. In addition, the corporation pays Able a $12,000 salary and distributes an additional $42,000 to Able and $28,000 to Baker. The corporation also makes a $100,000 principal payment on the loan.

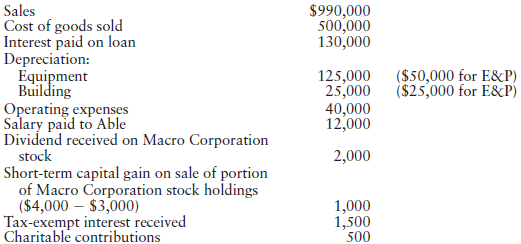

€¢ Results for 2018 are as follows:

Of these amounts, $158,000 is qualified production activities income. The deduction percentage is 9%.

€¢ In 2019, the corporation did not pay a salary to Able and made no distributions to the shareholders. The corporation, however, made a $30,000 principal payment on the loan.

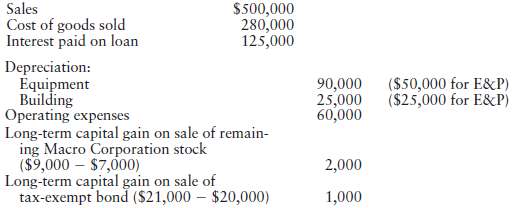

€¢ Results for 2019 are as follows:

Of these amounts, qualified production activities income is zero (because it is negative).

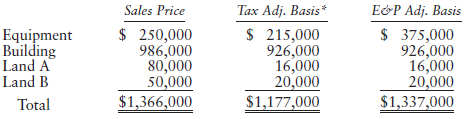

€¢ On January 2, 2020, the corporation receives a refund for the 2019 NOL carried back to 2017. When carrying back the NOL, remember to recalculate the U.S. production activities deduction in the carryback year because of the reduced taxable income resulting from carryback. In addition, the corporation sells its assets, pays taxes on the gain, and pays off the $1.87 million remaining debt.

Immediately after these transactions, the corporation makes a liquidating distribution of the remaining cash to Able and Baker. The remaining cash is $348,639, which the corporation distributes in proportion to the shareholders€™ ownership (60% and 40%). Assume that the shareholder€™s long-term capital gains will be taxed in 2020 at 23.8% (the 20% maximum capital gains rate plus the 3.8% rate on net investment income).

Required:

a. Determine the tax consequences of the corporate formation to Able, Baker, and Lifecycle Corporation.

b. For 2017 through 2019, prepare schedules showing corporate taxable income, taxes, and E&P activity. Assume that Lifecycle pays its taxes in the same year they accrue.

c. For 2020, prepare a schedule showing the results of this year€™s transactions on Lifecycle Corporation, Able, and Baker.

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Distribution

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer:

Federal Taxation 2018 Comprehensive

ISBN: 9780134532387

31st Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson