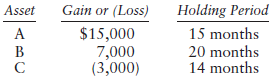

Trisha, whose tax rate is 35%, sells the following capital assets in 2017 with gains and losses

Question:

in 2017 with gains and losses as shown:

a. Determine Trisha€™s increase in tax liability as a result of the three sales. All assets are stock heldfor investment. Ignore the effect of increasing AGI on deductions and phase-out amounts.

a. Determine Trisha€™s increase in tax liability as a result of the three sales. All assets are stock heldfor investment. Ignore the effect of increasing AGI on deductions and phase-out amounts.b. Determine her increase in tax liability if the holding period for asset B is 8 months.

c. Determine her increase in tax liability if the holding periods are the same as in Part a but asset B is an antique clock.

d. Determine her increase in tax liability if her tax rate is 39.6%.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2018 Comprehensive

ISBN: 9780134532387

31st Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted: