Amorico Pty Ltd scrapped the following machines as worthless. Depreciation expense was recorded last on 31 December

Question:

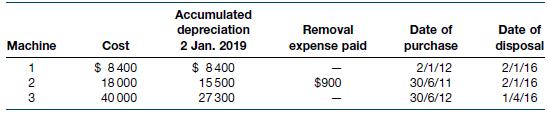

Amorico Pty Ltd scrapped the following machines as worthless.

Depreciation expense was recorded last on 31 December 2018.

Required

Prepare separate entries to record the disposal of the machines by Amorico Pty Ltd.

Transcribed Image Text:

Machine 1 2 3 Cost $ 8400 18000 40 000 Accumulated depreciation 2 Jan. 2019 $ 8400 15500 27 300 Removal expense paid $900 Date of purchase Date of disposal 2/1/12 2/1/16 30/6/11 2/1/16 30/6/12 1/4/16

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 40% (5 reviews)

Answered By

Mahesh G

I have more than 7 years of experience in teaching physics, mathematics and python programming to more than 600 students including both online and offline tutoring.

I follow the following 7 step fundamental approach towards tutoring.

1. Curiosity, scope, enlightenment of the topic in hand.

2. Problem Definitions and elaboration.

3. Requisite mathematics, analytical abilities and quantitative

aptitude.

4. Preparing Algorithms for problem statement.

5. Concepts with analogies and building algorithm.

6. Introspection and improvising.

7. Daily class wise Cheat sheets(its not cheating) for consolidation.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield

Question Posted:

Students also viewed these Business questions

-

Amorico Pty Ltd scrapped the following machines as worthless: Machine Cost Accumulated depreciation 2 Jan. 2016 Removal expense paid Date of purchase Date of disposal 1 2 3 $8 400 18000 40 000 $8 400...

-

Onslow Co. purchases a used machine for $192,000 cash on January 2 and prepares it for use the next day at a cost of $8,000. On January 3, it is installed on a required operating platform costing...

-

Entity A sells computer accessories in Hong Kong for many years. For delivery purpose, a motor van is owned by Entity A. It was bought on 1 January 2016 with an economic life of 8 years and a...

-

The distance between the K+ and Cl ions in KCl is 2.80 1010 m. Calculate the energy required to separate the two ions to an infinite distance apart, assuming them to be point charges initially at...

-

Grant, Inc., acquired 30% of South Co.'s voting stock for $200,000 on January 2, Year 1, and did not elect the fair value option. The price equaled the carrying amount and the fair value of the...

-

Consider the conditions of Problem 7.36, but now allow for radiation exchange between the surface of the heating element \((\varepsilon=0.8)\) and the walls of the duct, which form a large enclosure...

-

Why are deposits not the assets of the bank? Explain.

-

Compute activity-based cost rate, time equations CAN Company sells multiple products and uses a time-driven ABC system. The companys products must be wrapped individually before shipping. The...

-

Many things have changed over the years with ERM: how we handle it, the compliance issues, the importance of it, etc. What do you see as the future of ERM and how it will impact organizations?

-

On 3 January 2017, Bennetti Ltd paid $33 000 for a machine with a useful life of 10 years and a residual value of $3000. On 31 December 2021, accumulated depreciation on the machine was $15 000. The...

-

Surguy Ltd has disclosed the following noncurrent asset classes as at 30 June 2019. At 1 July 2019, the directors of Surguy Ltd decide to adopt the revaluation model and revalue the noncurrent asset...

-

The population P(t) of mosquito larvae growing in a tree hole increases according to the logistic equation with growth constant k = 0.3 day1 and carrying capacity A = 500. (a) Find a formula for the...

-

At 3 1 st March, 2 0 2 3 , AB Ltd , had an Authorized Capital of K 3 5 , 0 0 0 divided into 1 0 , 0 0 0 7 . 5 % noncumulative per share being due on 3 0 th June, 1 9 6 4 . per share paid, the...

-

A Leadership and Workforce Development Perspective. The literature review should discuss the related literature, organized by topic or themes (not a list of sources). A literature review includes...

-

Critical Success Factors (CSF) are elements that are necessary for an organization or a project to attain its objectives. For example, Chief Executive support is a CSF for corporate sustainability...

-

Ultra Ceramic Products presented the following data for its operations for the month of October, 2020: Dept 1 Work in process, July t. 1(Conversion costs, 60%) 7,000 units Transferred to Dept 2 Work...

-

Choose a global organizational leader who demonstrated how a high level of ethical communication via social media technologies have worked best at building trust with virtual stakeholders. Identify a...

-

Consult Paragraphs 5-7 of PCAOB Auditing Standard No. 13. Comment about how your understanding of the risks identified at WorldCom (in Question 14) would influence the nature, timing, and extent of...

-

Kims Konstructions has assembled the following data for a proposed straw-reinforced brick maker (SRBM): SRBM Cost: $26,000 Life: 5 years Revenue (p.a.) $11,000 Operating Expenses (p.a.) $3,000...

-

Norman Co., a fast-growing golf equipment company, uses U.S. GAAP . It is considering the issuance of convertible bonds. The bonds mature in 10 years, have a face value of $400,000, and pay interest...

-

Briefly discuss the convergence efforts that are under way by the IASB and FASB in the area of dilutive securities and earnings per share.

-

How is anti dilution determined when multiple securities are involved?

-

Ray Company provided the following excerpts from its Production Department's flexible budget performance report. Required: Complete the Production Department's Flexible Budget Performance Report....

-

Problem 1 5 - 5 ( Algo ) Lessee; operating lease; advance payment; leasehold improvement [ L 0 1 5 - 4 ] On January 1 , 2 0 2 4 , Winn Heat Transfer leased office space under a three - year operating...

-

Zafra and Stephanie formed an equal profit- sharing O&S Partnership during the current year, with Zafra contributing $100,000 in cash and Stephanie contributing land (basis of $60,000, fair market...

Study smarter with the SolutionInn App