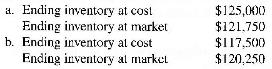

Apply the lower-of-cost-or-market rule. (LO 5) In each case, indicate the correct amount to be reported for

Question:

Apply the lower-of-cost-or-market rule. (LO 5)

In each case, indicate the correct amount to be reported for the inventory on the year-end balance sheet.

Transcribed Image Text:

a. Ending inventory at cost Ending inventory at market $125,000 $121,750 b. Ending inventory al cost $117,500 Ending inventory at market $120,250

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (1 review)

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The Sales Refund Payable account: Multiple select question. Is reported on the income statement Is a current liability Is a contra revenue account Is reported on the balance sheet

-

HOMEY Electronics (HE) is one of the famous electronics businesses in the Kingdom of Bahrain. Over the past decade, HOMEY has emerged as a leading competitor in the industry, due to the exceptional...

-

Pregunta 1 Sistema relacionado con el equilibrio y el movimiento del cuerpo a. Vestibulares b. Endocrino c. Simptico d. Inmunolgico Pregunta 2 Una alteracin en el sistema vestibular puede presentar...

-

On January 1, 2010, Phelps Company purchased an 85% interest in Sloane Company for $955,000 when the retained earnings of Sloane Company were $150,000. The difference between implied and book value...

-

Carbon-dioxide gas at 3 MPa and 500 K flows steadily in a pipe at a rate of 0.4 kmol/s. Determine (a) the volume and mass flow rates and the density of carbon dioxide at this state. If CO2 is cooled...

-

Use a computer algebra system to plot the projections onto the xy- and xz-planes of the curve r(t) = (t cos t, t sin t, t) in Exercise 25. Data From Exercise 25 Let C be the curve given by r(t) = (t...

-

1 5 Give some illustrations of your own about the way in which the history of a country has affected its culture, and how that in turn affects the management of organisations there.

-

The financial condition of White Co. Inc. is expressed in the following accounting equation: Required a. Are dividends paid to creditors or investors? Explain why. b. How much cash is in the Retained...

-

es Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 13% increase in sales. 3. Construct a...

-

Calculate gross profit and gross profit percentage: FIFO and LIFO. (LO 6) Given the following information, calculate the gross profit and gross profit ratio under (a) FIFO periodic and under (b) LIFO...

-

Apply the lower-of-cost-or-market rule. (LO 5) Use the following data to answer the following question. What inventory amount will this firm report on its balance sheet at December 31, 2011? Ending...

-

Randall Corporation plans to borrow $276,000 for one year at 19 percent from the Waco State Bank. There is a 28 percent compensating balance requirement. Randall Corporation keeps minimum transaction...

-

2. See US Debt Clock and answer the following: (Hint: Take a screenshot of the Debt Clock) (2) A. What is the current US deficit and the total federal debt? (1) B What is the net interest...

-

Q. Is GDP per capita a good measure of a society's welfare? Why or why not? (150 Words)

-

On May 3, the Happy Company wrote off the $4,300 uncollectible account of its customer, A. Johnson. The entry or entries Happy makes to record the write off of the account on May 3 is: Allowance for...

-

Who is responsible for the financial statements and maintaining effective internal control over financial reporting? Where did you find this in the annual report? What accounting rules are required...

-

8. Chad owned an office building that was destroyed in a tornado. The adjusted basis of the building at the time was $890,000. After the deductible, Chad received an insurance check for $850,000. He...

-

Volkswagen Group reports the following information for property, plant and equipment as of December 31, 2010, along with additions, disposals, depreciation, and impairments for the year ended...

-

Read the Forecasting Supply Chain Demand Starbucks Corporation case in your text Operations and Supply Chain Management on pages 484-485, then address the four questions associated with the...

-

The cost of partially completed goods at the end of the period would be Ending work in process inventory Cost of goods sold Beginning finished goods inventory Beginning work in process inventory

-

At a 3% (EAR) rate of interest, you will quadruple (increase four folds) your money in approximately ____ years.

-

Smile Company makes baked goods. The budgeted sales are $620,000, budgeted variable costs are $260,400, and budgeted fixed costs are $237,800. What is the budgeted operating income?

Study smarter with the SolutionInn App