Brockbank Builders Ltd is preparing a cash budget for May and June of 2019. Past records reveal

Question:

Brockbank Builders Ltd is preparing a cash budget for May and June of 2019. Past records reveal that 20% of all credit sales are collected during the month of sale, 60% in the month following the sale, 10% in the second month following the sale and 10% in the third month following the sale. The company pays for 75% of purchases in the month after purchase, and the balance is paid in the month following that.

Selling expenses amount to $6600 per month plus 15% of monthly sales. Administrative expenses are estimated to be $13 200 per month, which includes $4800 of depreciation expense.

Finance expenses are $1200 per month. All selling and distribution, administrative, and finance and other expenses (except depreciation) are paid for when incurred.

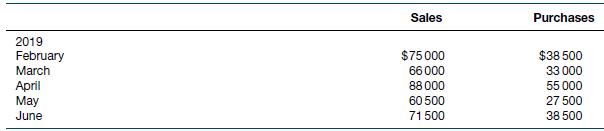

It is planned to purchase equipment during May 2019 at a cost of $6600. A $9000 loan payable will be repaid during June 2019. The interest due at maturity will be $1650. The company’s expected Cash at Bank balance at 1 May 2019 is $13 500. Estimated sales and purchases data are as follows.

Required

Ignoring GST, prepare a cash budget for May and June 2019, by month and in total.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield