Browne Cleaning and Gardening Services commenced on 1 June 2020 when Lorne Browne contributed $120 000 into

Question:

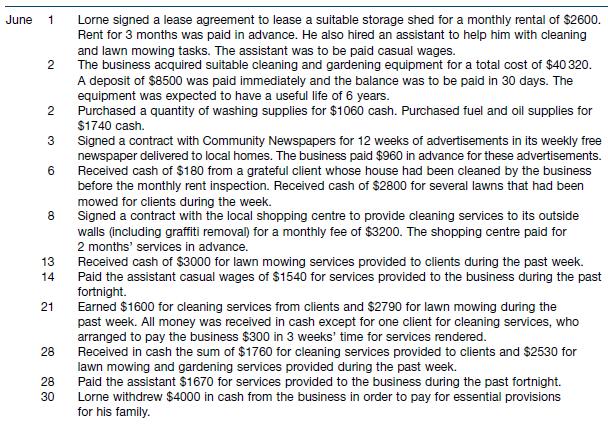

Browne Cleaning and Gardening Services commenced on 1 June 2020 when Lorne Browne contributed $120 000 into a business bank account. The following transactions occurred in the month of June. Ignore GST.

Additional information

The accounting period closed on 30 June 2020, and the following additional data was available.

1. Wages owing to the assistant on 30 June amounted to $620.

2. A physical count showed that only $260 of washing supplies and $750 of fuel and oil supplies were still on hand.

3. Four weeks of advertisements had appeared in the local community newspaper up to 30 June.

4. Cleaning services of $550 had been rendered to clients on 29 June but the invoice to bill these clients had not been prepared.

5. The business had provided cleaning services to its shopping centre client for 3 weeks of the first month (assumed to be 4 weeks long).

Required

(a) Prepare journal entries to record the June 2020 transactions for Browne Cleaning and Gardening Services and post these journal entries to suitable running balance ledger accounts. Provide appropriate account numbers and journal page numbers and record them in post ref columns.

(b) Prepare an unadjusted trial balance as at 30 June 2020.

(c) Prepare adjusting entries and post them to the ledger accounts. Be careful to ensure that all adjusting entries have been recorded. Explain the reasons for each adjusting entry that you have made.

(d) Prepare an adjusted trial balance.

(e) Prepare closing entries, post them to the accounts and prepare a post‐closing trial balance.

(f) Prepare the income statement, the statement of changes in equity and the balance sheet as at 30 June 2020.

(g) Prepare any suitable reversing entries on 1 July 2020 and post them to the accounts.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield