Form a five-person team. Each team member should identify a public company and obtain its financial reports

Question:

Form a five-person team. Each team member should identify a public company and obtain its financial reports (available at www.sec.gov, or from the company website). If looking on the SEC website, look under the section for "search for company filings" and select the company's Form 10-K (annual report). Each member should find the company disclosures relative to the accounting for property, plant, and equipment, such as the following example:

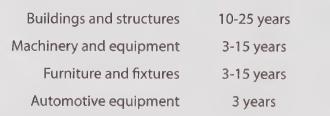

Property, plant, and equipment — For financial reporting purposes, depreciation is computed using the straight-line method over the estimated useful lives of the related assets as follows:

Maintenance and repairs are charged to expense as incurred; renewals and betterments that significantly extend the useful life of the asset are capitalized.

Each team member should compile information about company name, depreciation method in use, and estimated useful lives for the selected company. Then, the team should compile a master list for all five companies. Discuss the similarities and differences. How can such information, in conjunction with information about cost and accumulated depreciation balances, be used to judge the relative age of a company's fixed assets? Of what value is such an assessment? In class, consider merging each team's data into a class-wide study to determine the frequency of use of straight-line, double-declining balance, and other methods.

Step by Step Answer: