Grant Price is conducting an audit of the property, plant, and equipment records of Wellron Corporation. Grant

Question:

Grant Price is conducting an audit of the property, plant, and equipment records of Wellron Corporation.

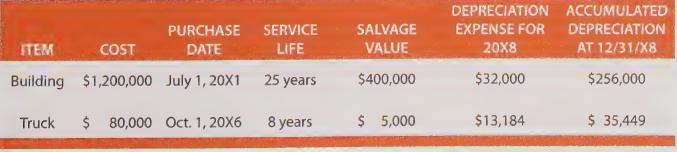

Grant selected two specific assets for closer inspection. Grant has examined documentation related to each asset's original purchase and compared it to the recorded cost, physically inspected the item to determine that it is still in the possession of the company, and conducted other similar assurance procedures.

The final step in the audit of these accounts is to test the calculations of depreciation expense and accumulated depreciation. Grant has asked you to perform this final procedure for 20X8. Below is a schedule of the two assets, with the depreciation values determined by WellronT.h e building was depreciated by the straight-line method, and the truck by the double-declining balance method. Determine if the indicated depreciation values are correct.

Step by Step Answer: