Gregory and Simpson share profits in a proportion of 60:40. Gregory is entitled to a salary allowance

Question:

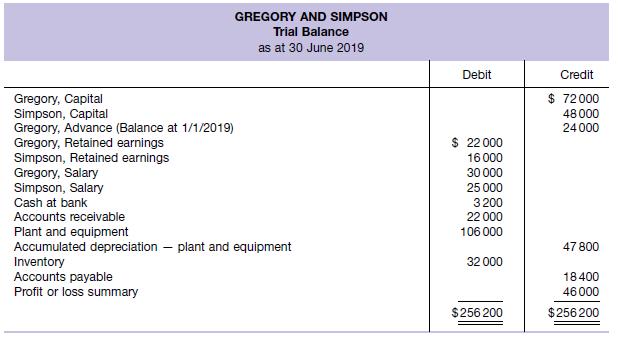

Gregory and Simpson share profits in a proportion of 60:40. Gregory is entitled to a salary allowance of $60 000 p.a., and Simpson is entitled to $50 000 p.a. Capitals are fixed at Gregory $72 000 and Simpson $48 000. Interest is to be calculated on partners’ capital, advances, and drawings in excess of salary at 8% p.a. The trial balance after the determination of profit for the 6‐month period is shown below.

Gregory had withdrawn $12 000 cash on 1 April; Simpson’s cash drawings included $24 000 on 1 March and $12 000 on 1 May.

Required

(a) Prepare the Profit Distribution account for 6 months ended 30 June 2019.

(b) Prepare the Retained Earnings accounts for each partner at 30 June 2019.

(c) Prepare a balance sheet as at 30 June 2019.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield