In early July 2019, Masterton Ltd is considering the acquisition of some machinery for $1 200 000

Question:

In early July 2019, Masterton Ltd is considering the acquisition of some machinery for $1 200 000 to be used in the manufacture of a new product. The machinery has a useful life of 10 years, during which management plans to produce 500 000 units of the new product. The residual value of the machinery is $100 000.

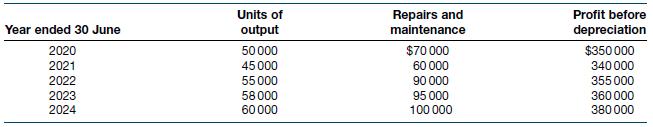

The following projections were made in order to select a depreciation method to be used for the machinery.

In calculating the profit before depreciation, all expenses have been deducted, including the repairs and maintenance expense. Ignore GST.

Required

(a) As the accountant for Masterton Ltd, prepare separate depreciation schedules for the machinery for the 5‐year period, using the following depreciation methods:

i. straight‐line

ii. diminishing balance

iii. sum‐of‐years’‐digits,

iv. units‐of‐production.

Use the following headings for each schedule: ‘Year ending 30 June’, ‘Annual depreciation expense’, ‘Accumulated depreciation’, ‘Carrying amount at end of year’.

(b) Prepare a report for management, stating the advantages and disadvantages of each depreciation method. Include in the report your recommendations on the choice of method consistent with the requirements of IAS 16/AASB 116. Support your recommendations with schedules showing the total annual cost of operating the machinery, and the profit after depreciation.

(c) Write an addendum to your report, making further recommendations based on the following additional information supplied to you by management. Firstly, as an alternative to acquiring the machinery, management is considering leasing the machinery for an annual rental charge of $250 000; all repairs and maintenance costs would be paid by the lessor. Secondly, management wishes to show the most favourable financial results in anticipation of acquiring a long‐term bank loan.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield