Martin and Brett share profits on a 60:40 basis respectively. On 1 July 2019 the equity accounts

Question:

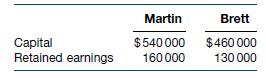

Martin and Brett share profits on a 60:40 basis respectively. On 1 July 2019 the equity accounts were as follows.

The partners were entitled to 12% interest on capital. Brett ran the business and received a salary of $80 000. During the year Martin withdrew $48 000 in cash and Brett withdrew $12 000. The profits for the year ended 30 June 2020 were $500 000 before providing for interest on capital balances and Brett’s salary.

Required

Prepare the Profit Distribution account and the partners’ Retained Earnings accounts for the year ended 30 June 2020.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield

Question Posted: