Moncrief Corporation is a small business operating in a state where a tax on income is contrary

Question:

Moncrief Corporation is a small business operating in a state where a tax on income is contrary to the state’s constitution. In an effort to raise revenue, the state has imposed a tax on business receipts for services provided to customers (total revenues, whether collected during the period or not). The tax is equal to 1% of revenues in excess of \($300\),000.

Moncrief prepared its state tax return by adding up the total deposits to the company’s bank account during the year. Total deposits were \($1\),240,000, and the company paid taxes of \($9\),400 ((\($1\),240,000 - \($300\),000) X 1%).

Assume you are an auditor for the state, and Moncrief has been randomly selected for a routine review. You immediately find that the company does not maintain a typical journal/ledger system, and is fundamentally clueless about proper accounting procedures.

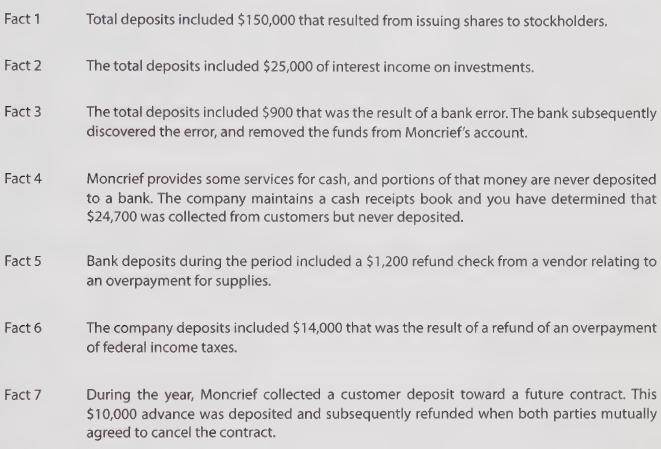

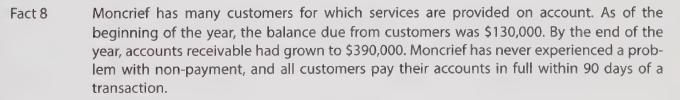

You have discovered the following limited information as part of your examination:

(a) Prepare an analysis to determine the correct amount of revenue for purposes of computing the tax.

(b) Prepare journal entries for the “revenue” cycle, as well as the other cash items described.

(c) Prepare a general ledger account supporting the revenue calculation.

Step by Step Answer: