Morrison Supply sells pressured air devices that assist patients with breathing disorders during sleep. These devices are

Question:

Morrison Supply sells pressured air devices that assist patients with breathing disorders during sleep. These devices are delivered to patients immediately upon completion of a diagnostics exam, and are subsequently billed to insurance companies. Insurance companies sometime refuse to pay and/or only agree to a reduced price. Patients are then responsible for any amount denied by the insurance company, but are often unable or unwilling to pay. Because clinical standards of cleanliness must be maintained, Morrison is unable to accept returns for resale to others.

Morrison is reluctant to litigate to collect unpaid amounts. As a result, Morrison experiences a high rate of uncollectible accounts, and prepares a monthly adjusting entry for uncollectibles that is equal to 20% of sales.

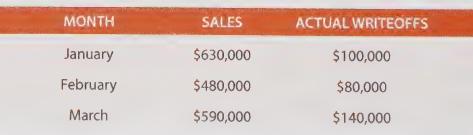

Morrison's Monthly sales and write-offs for the first quarter of 20X7 follow:

(a) Prepare monthly journal entries to summarize sales on account, the recording of the provision for uncollectibles, and the actual write-offs.

(b) The provision for uncollectibles is established at 20% of sales. Why are the monthly write-offs not also proportional to that month's sales? Does the amount written off ina particular month impact net income for that month?

(c) Some companies book allowances based on credit sales, rather than total sales. Morrison's allowance was based on total sales. Why might this be logical for Morrison, and when might the other alternative make more sense?

(d) Morrison's CFO attended a trade group conference, and learned providers of this service in other cities have begun offering a 10% cash discount if the patient will pay the full amount themselves.

The patient then deals directly with their insurance carrier for reimbursement. What are your thoughts on this policy?

(e) Morrison Supply is contemplating issuing shares of stock to a group of outside investors. The CEO has requested the CFO to begun booking the allowance account at 12% of sales, rather than 20% of total sales. What might be the motivation behind this request, and how should the CFO respond?

Step by Step Answer: