On 1 July 2019, Chadstone Ltd purchased a motor vehicle which is estimated to have a $6000

Question:

On 1 July 2019, Chadstone Ltd purchased a motor vehicle which is estimated to have a $6000 residual value and a useful life of 4 years. On 1 July 2021, the company purchased plant and equipment which is estimated to have a residual value of $10 000 and a useful life of 4 years.

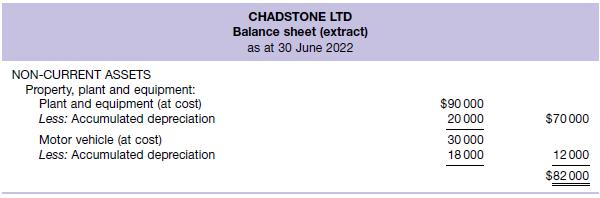

The following is an extract from the balance sheet showing the carrying amounts of these assets at 30 June 2022.

Required

(a) For each asset, calculate the percentage of useful life expired.

(b) What decisions will management need to make in the next financial year?

(c) Prepare the journal entries to record depreciation expense at 30 June 2023.

(d) Prepare an extract from the balance sheet at 30 June 2023 (assuming no new assets have been purchased).

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield