On 1 June 2020, Aaron Draper began trading as a landscape material supplier. The transactions for the

Question:

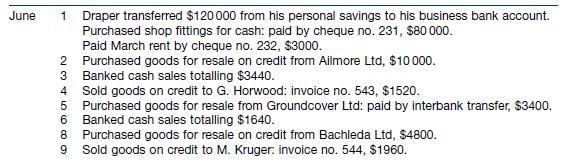

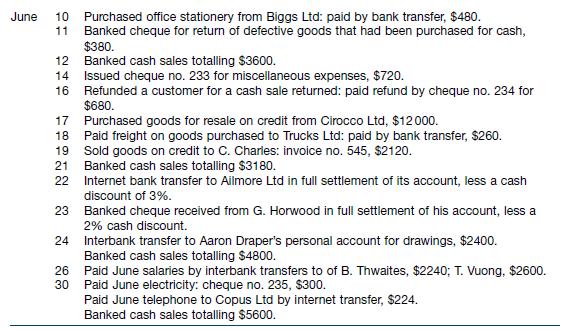

On 1 June 2020, Aaron Draper began trading as a landscape material supplier. The transactions for the month of June 2020 were as follows (ignore GST).

The following additional information is available.

1. A physical inventory count held at the close of business on 30 June 2020 revealed that the cost price of inventory on hand amounted to $12 000.

2. The June salary of a part‐time sales representative amounting to $800 was not paid until 2 July 2020.

3. Depreciation on shop fittings for the month of June amounted to $152.

Required

(a) Record the above transactions in the appropriate journals for the business of Aaron Draper.

(b) Post the entries in the journals to the general ledger as well as to the debtors and creditors subsidiary ledgers.

(c) Prepare the trial balance of Aaron Draper at 30 June 2020.

(d) Prepare schedules of debtors and creditors at 30 June 2020, and reconcile the totals with the balances of the related control accounts in the trial balance.

(e) Prepare the income statement of Aaron Draper for the month ended 30 June 2020.

(f) Prepare the balance sheet of Aaron Draper at 30 June 2020.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield