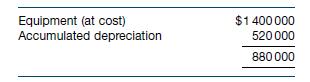

On 30 June 2019, Wong Ltd reported the following information for equipment in its statement of financial

Question:

On 30 June 2019, Wong Ltd reported the following information for equipment in its statement of financial position.

Investigation of the property and plant records showed that the equipment consisted of two items:

a machine (no. 1) that cost the company $800 000 and had a carrying amount of $420 000 at 30 June 2019, and another machine (no. 2) that originally cost $600 000 and had a carrying amount at 30 June 2019 of $460 000. Both machines are depreciated on a straight‐line basis over 10 years.

On 1 January 2020, the directors of Wong Ltd decided to switch the valuation method from the cost model to the revaluation model. Machine no. 1 was revalued to its fair value of $480 000, with an expected future useful life of 6 years, and machine no. 2 was revalued to $450 000, with an expected remaining useful life of 6 years.

On 30 June 2020, the fair value of machine no. 1 was assessed at $450 000, and the future useful life was estimated as 5 years. For machine no. 2, fair value was assessed to be only $300 000, and its future useful life to be 4 years because of a certain degree of commercial obsolescence.

Required

Prepare general journal entries for Wong Ltd for the equipment during the period from 1 July 2019 to 30 June 2020.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield