Question:

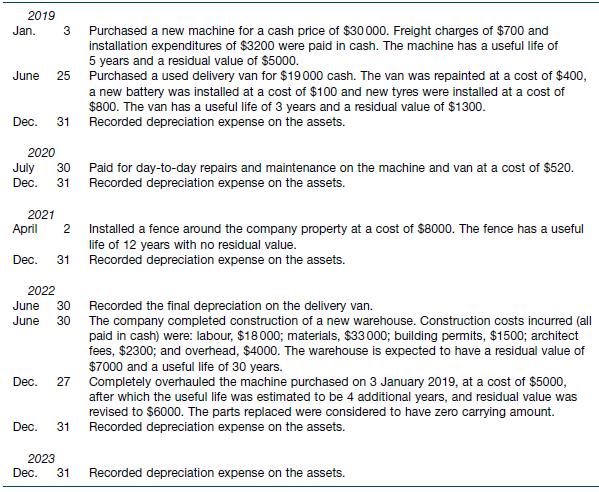

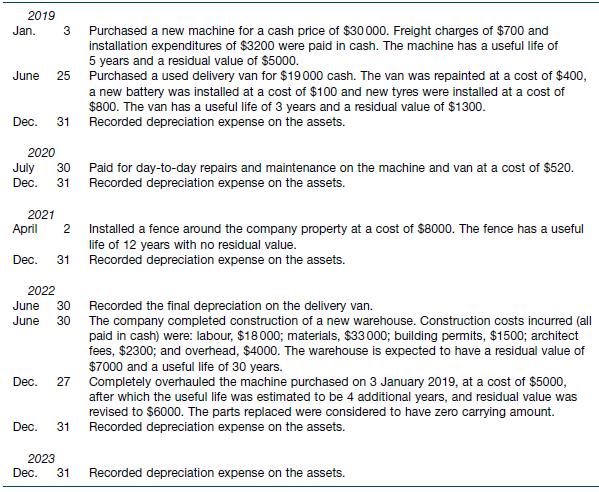

Over a 5‐year period, Downton Ltd completed the following transactions affecting non‐current assets in financial years ending 31 December. The company uses straight‐line depreciation on all depreciable assets and records depreciation to the nearest month. Ignore GST.

Required

(a) Prepare general journal entries to record all the transactions of Downton Ltd.

(b) Prepare a schedule showing the cost and accumulated depreciation of each asset after recording depreciation on 31 December 2023.

(c) Post the journal entries in requirement (a) to the appropriate non‐current asset accounts from 3 January 2019 to 31 December 2023.

Transcribed Image Text:

2019 Jan. 3 June 25 Dec. 31 2020 July 30 Dec. 31 2021 April 2 Dec. 31 2022 June 30 June 30 Dec. 27 Dec. 31 Purchased a new machine for a cash price of $30000. Freight charges of $700 and installation expenditures of $3200 were paid in cash. The machine has a useful life of 5 years and a residual value of $5000. Purchased a used delivery van for $19000 cash. The van was repainted at a cost of $400, a new battery was installed at a cost of $100 and new tyres were installed at a cost of $800. The van has a useful life of 3 years and a residual value of $1300. Recorded depreciation expense on the assets. Paid for day-to-day repairs and maintenance on the machine and van at a cost of $520. Recorded depreciation expense on the assets. Installed a fence around the company property at a cost of $8000. The fence has a useful life of 12 years with no residual value. Recorded depreciation expense on the assets. Recorded the final depreciation on the delivery van. The company completed construction of a new warehouse. Construction costs incurred (all paid in cash) were: labour, $18000; materials, $33000; building permits, $1500; architect fees, $2300; and overhead, $4000. The warehouse is expected to have a residual value of $7000 and a useful life of 30 years. Completely overhauled the machine purchased on 3 January 2019, at a cost of $5000, after which the useful life was estimated to be 4 additional years, and residual value was revised to $6000. The parts replaced were considered to have zero carrying amount. Recorded depreciation expense on the assets. 2023 Dec. 31 Recorded depreciation expense on the assets.