Record adjustments. (LO 1, 2, 3) The following is a partial list of financial statement items from

Question:

Record adjustments. (LO 1, 2, 3)

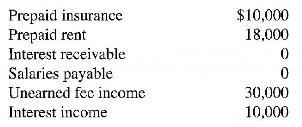

The following is a partial list of financial statement items from the records of Marshall's Company at December 31, 2008.

Additional information includes the following:

1. The insurance policy indicates that on December 31,2008 , only 5 months remain on the 24-month policy that originally cost \(\$ 18,000\).

2. Marshall's has a note receivable with \(\$ 2,500\) of interest due from a customer on January 1,2009 .

3. The accounting records show that one-third of the fees paid in advance by a customer on July 1,2008 , has now been earned.

4. The company paid \(\$ 18,000\) for rent for 9 months starting on August 1, 2008 .

5. At year-end, Marshall's owed \(\$ 7,000\) worth of salaries to employees for work done in December 2008. The next payday is January 5, 2009.

\section*{Required}

a. Use the accounting equation to show the adjustments that must be made prior to the preparation of the financial statements for the year ended December 31, 2008.

b. Calculate the account balances that would be shown on Marshall's financial statements for the year ended December \(31,2008\).

Step by Step Answer: