The accounting firm of Haynes and Haynes was asked by one of its clients to help them

Question:

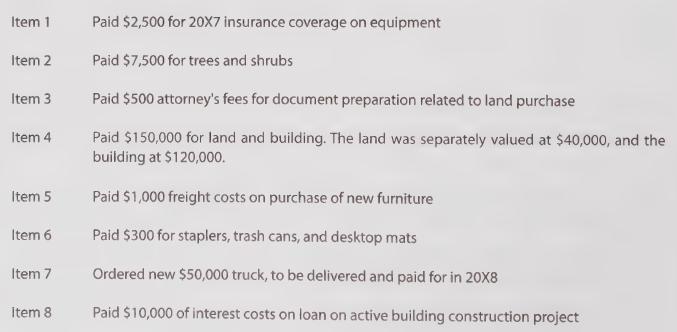

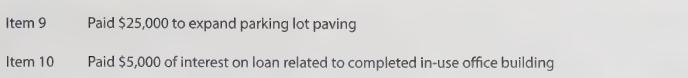

The accounting firm of Haynes and Haynes was asked by one of its clients to help them properly account for various transactions related to plant and equipment. The client prepared the following list of transactions that occurred during 20X7. Because the client was not sure what to do with these activities, they debited an account called "Suspense" and credited "Cash" for each expenditure. The only exception relates to item #7, for which no entry has been recorded.

You should examine the following activities, and prepare a spreadsheet showing how the costs should be allocated to specific Land, Land Improvement, Building, Equipment, or expense accounts (you may assume that the spreadsheet data are for the year ending December 31, 20X7, and disregard any depreciation implications).

The blank worksheet template will expedited your completion of this problem. After you complete the allocation, prepare a suggested correcting journal entry (i.e., debit the various asset/expenses and credit suspense).

Step by Step Answer: