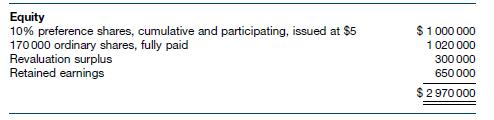

The equity of Instrumental Issues Ltd at 30 June 2020 is as follows. Required Based on the

Question:

The equity of Instrumental Issues Ltd at 30 June 2020 is as follows.

Required

Based on the above information, answer the following questions.

(a) What is the issue price per share of the ordinary shares?

(b) If the directors decide to declare a final dividend of 40c per share on the ordinary shares, what journal entry would be necessary on 30 June 2020, assuming no ratification of the dividend is required by shareholders?

(c) If the total dividend to be paid on all shares is to equal $400 000, how much money would be paid to the preference shareholders and to the ordinary shareholders assuming (independent scenarios)?

i. There are no accumulated dividends owing to preference shares and the preference shares are entitled to participate in additional dividends once the ordinary shareholders have received 30c per share.

ii. There is 1 year of dividends in arrears on the preference shares and the preference shares are entitled to participate in additional dividends once the ordinary shareholders have received 30c per share.

(d) What are the necessary journal entries to provide for the dividends in questions (c)i. and ii.

respectively?

(e) Assume that the market price of each ordinary share is currently $8. If a bonus dividend is to be provided out of the revaluation surplus to ordinary shareholders on the basis of 1 share for every 5 shares held, what is the journal entry required on 30 June 2020?

(f) Assuming the existence of items in questions (c)i. and (e) and no other changes to issued capital for the year, and that the balance of retained earnings at the beginning of the year was $450 000, prepare a statement of changes in equity for the year ended 30 June 2020 for external reporting purposes to comply with current accounting standards.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield