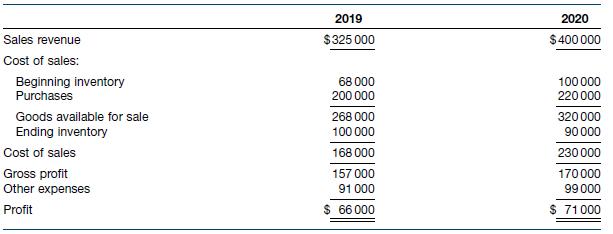

The income statements for Campbells Camping Ltd for the year ended 31 December for 2 years are

Question:

The income statements for Campbell’s Camping Ltd for the year ended 31 December for 2 years are shown below.

The following information has been discovered concerning 2019.

1. On 23 December, Campbell’s Camping Ltd recorded goods purchased at a cost of $2000.

The terms were EXW. The goods were delivered by the seller to the transport company on 27 December. The goods were not included in the ending inventory because they had not arrived.

2. Campbell’s Camping Ltd sells goods that it does not own on a consignment basis. Consigned goods on hand at year‐end were included in inventory at a cost of $6000.

3. A purchase of goods worth $4500 was made in December, but not recorded until January. The goods were received on 28 December and included in the physical inventory.

4. A sale of goods costing $2000 was made and recorded in December. Since the buyer requested that the goods be held for later delivery, the items were on hand and included in inventory at year‐end.

5. Campbell’s Camping Ltd sold goods costing $1400 for $2000 on 26 December. The terms were DDP. The goods arrived at the destination in January. The sale was recorded in 2019, and the goods were excluded from the ending inventory.

Required

(a) Determine the correct ending inventory figure for 31 December 2019.

(b) Prepare revised income statements for 2019 and 2020.

(c) Determine the total profit for the 2‐year period, both before and after the revisions. Why are these figures similar or different?

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield