Question:

Tidwell Corporation's accounting staff was unsure how to account for certain expenditures relating to its property, plant, and equipment. As a result, the company has delayed recording entries related to the following transactions. In addition, until these items are resolved, the determination of depreciation expense for the year has been delayed.

Prepare journal entries for each of the four described expenditures. Then, calculate depreciation, as appropriate, for the expenditure and/or related assets. Assume straight-line depreciation in each case.

Transcribed Image Text:

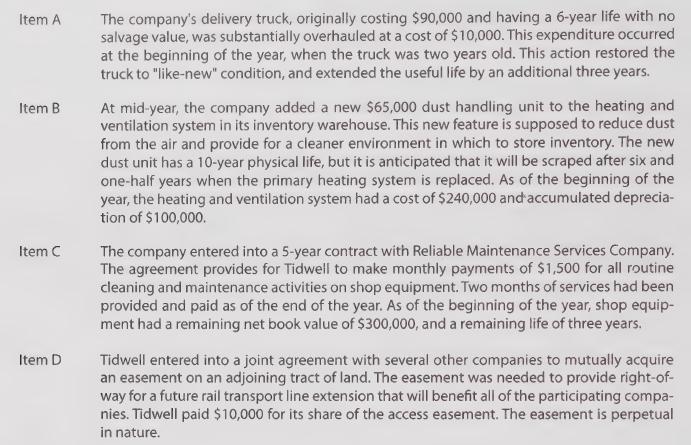

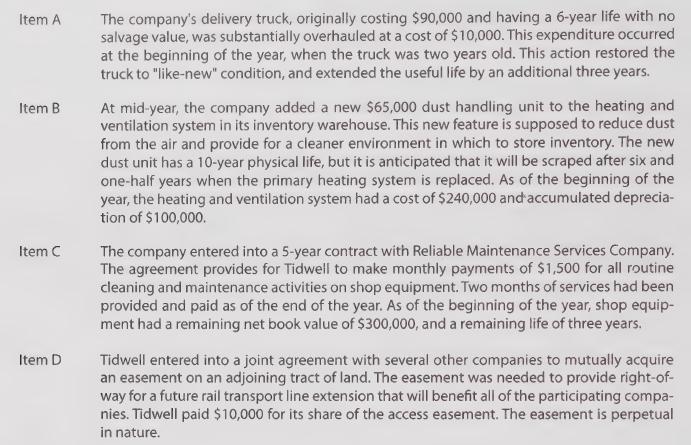

Item A Item B Item C Item D The company's delivery truck, originally costing $90,000 and having a 6-year life with no salvage value, was substantially overhauled at a cost of $10,000. This expenditure occurred at the beginning of the year, when the truck was two years old. This action restored the truck to "like-new" condition, and extended the useful life by an additional three years. At mid-year, the company added a new $65,000 dust handling unit to the heating and ventilation system in its inventory warehouse. This new feature is supposed to reduce dust from the air and provide for a cleaner environment in which to store inventory. The new dust unit has a 10-year physical life, but it is anticipated that it will be scraped after six and one-half years when the primary heating system is replaced. As of the beginning of the year, the heating and ventilation system had a cost of $240,000 and accumulated deprecia- tion of $100,000. The company entered into a 5-year contract with Reliable Maintenance Services Company. The agreement provides for Tidwell to make monthly payments of $1,500 for all routine cleaning and maintenance activities on shop equipment. Two months of services had been provided and paid as of the end of the year. As of the beginning of the year, shop equip- ment had a remaining net book value of $300,000, and a remaining life of three years. Tidwell entered into a joint agreement with several other companies to mutually acquire an easement on an adjoining tract of land. The easement was needed to provide right-of- way for a future rail transport line extension that will benefit all of the participating compa- nies. Tidwell paid $10,000 for its share of the access easement. The easement is perpetual in nature.