Trang Nguyen operates a roofing business that specialises in replacing broken tiles and cleaning and repairing roofs

Question:

Trang Nguyen operates a roofing business that specialises in replacing broken tiles and cleaning and repairing roofs and gutters. He began business in April 2019 but has not yet established a formal set of records. His son, Tram, has prepared cash receipts and payment statements for each of the first 3 months of the business, but Trang Nguyen is worried about relying on them. He asks you to prepare a ‘proper’ set of financial statements for the month of June.

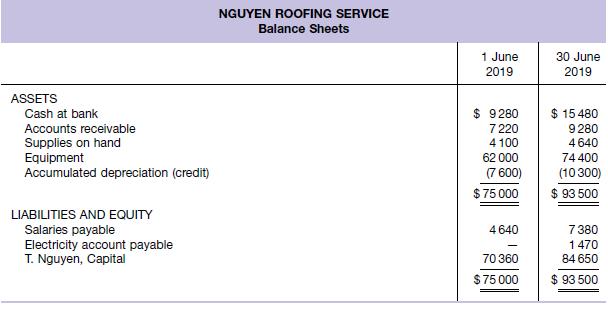

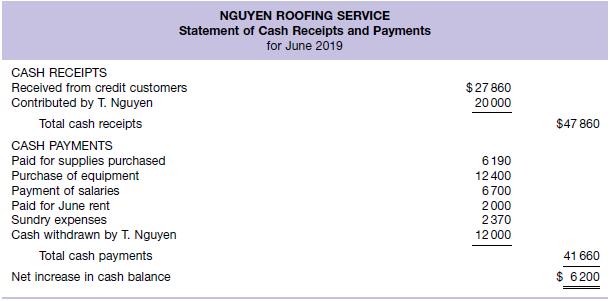

By reviewing the bank statements, cheque butts, invoice files and other data, you derive a set of balance sheets at 1 June and 30 June. These are shown below, followed by a statement of cash receipts and payments for June. GST is ignored.

Required

(a) From the information presented, prepare an income statement on the accrual basis for the month of June.

(b) Illustrate the apparent correctness of your profit amount by preparing a statement of changes in equity for June 2019.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield