Advice to a Potential Investor Century Company was organized 15 months ago as a management consulting firm.

Question:

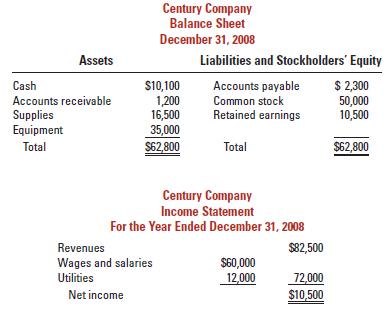

Advice to a Potential Investor Century Company was organized 15 months ago as a management consulting firm. At that time, the owners invested a total of $50,000 cash in exchange for stock. Century purchased equipment for $35,000 cash and supplies to be used in the business. The equipment is expected to last seven years with no salvage value. Supplies are purchased on account and paid for in the month after the purchase. Century normally has about $1,000 of supplies on hand. Its client base has increased so dramatically that the president and chief financial officer have approached an investor to provide additional cash for expansion. The balance sheet and income statement for the first year of business are as follows:

Required The investor has asked you to look at these financial statements and give an opinion about Century’s future profitability. Are the statements prepared in accordance with GAAP? Why or why not? Based on these two statements, what would you advise? What additional information would you need to give an educated opinion?

Step by Step Answer:

Financial Accounting The Impact On Decision Makers

ISBN: 9780324655230

6th Edition

Authors: Gary A. Porter, Curtis L. Norton