Case 2. (Learning Objective 4: Preparing financial statements; deciding to continue or shut down the business) On

Question:

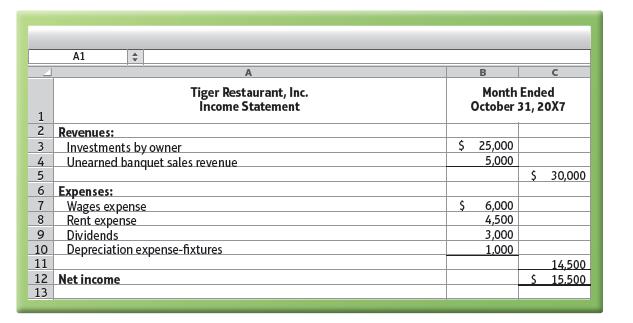

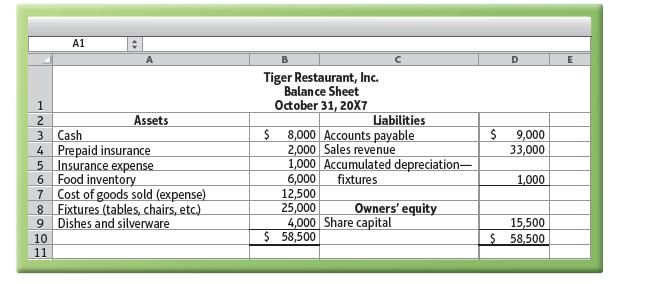

Case 2. (Learning Objective 4: Preparing financial statements; deciding to continue or shut down the business) On October 1, Lou Clark opened Tiger Restaurant, Inc. Clark is now at a crossroads. The October financial statements paint a glowing picture of the business, and Clark has asked you whether he should expand the business. To expand the business, Clark wants to be earning net income of $10,000 per month and have total assets of $50,000. Clark believes he is meeting both goals.

To start the business, Clark invested $25,000, not the $15,500 amount reported as “Share capital” on the Balance Sheet. The business issued $25,000 of shares to Clark. The bookkeeper plugged the $15,500 “Share capital” amount into the Balance Sheet to make it balance. The bookkeeper made some other errors too. Clark shows you the following financial statements that the bookkeeper prepared:

Requirement 1. Prepare corrected financial statements for Tiger Restaurant, Inc.: Income Statement, Statement of Changes in Equity, and Balance Sheet. Then, based on Clark’s goals and your corrected statements, recommend to Clark whether he should expand the restaurant.

Step by Step Answer:

Financial Accounting International Financial Reporting Standards Global Edition

ISBN: 9781292211145

11th Edition

Authors: Charles T. Horngren, C. William Thomas, Wendy M. Tietz, Themin Suwardy, Walter T. Harrison