Case 3. (Learning Objectives 3, 4: Valuing a business on the basis of its net income) Stanley

Question:

Case 3. (Learning Objectives 3, 4: Valuing a business on the basis of its net income)

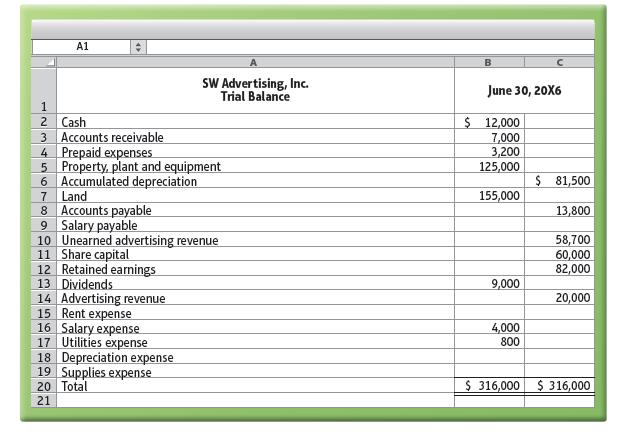

Stanley Williams has owned and operated SW Advertising, Inc., since its beginning, 10 years ago. Recently, Williams mentioned that he would consider selling the company for the right price.

Assume that you are interested in buying this business. You obtain its most recent monthly trial balance. Revenues and expenses vary little from month to month, and June is a typical month. Your investigation reveals that the trial balance does not include the effects of monthly revenues of $5,000 and expenses totaling $1,200. If you were to buy SW Advertising, you would hire a manager so you could devote your time to other duties. Assume that your manager would require a monthly salary of $5,000.

Requirements 1. Assume that the most you would pay for the business is 16 times the amount of monthly net income you could expect to earn from it. Compute this possible price.

2. Williams states that the least he will take for selling the business is two times its shareholders’

equity on June 30. Compute this amount.

3. Under these conditions, how much should you offer Williams? Give your reason. (Challenge)

Step by Step Answer:

Financial Accounting International Financial Reporting Standards Global Edition

ISBN: 9781292211145

11th Edition

Authors: Charles T. Horngren, C. William Thomas, Wendy M. Tietz, Themin Suwardy, Walter T. Harrison