Debt versus Preferred Stock Assume that you are an analyst attempting to compare the financial structures of

Question:

Debt versus Preferred Stock Assume that you are an analyst attempting to compare the financial structures of two companies.

In particular, you must analyze the debt and equity categories of the two firms and calculate a debt-to-equity ratio for each firm. The Liability and Equity categories of First Company at yearend appeared as follows:

First Company’s loan payable bears interest at 8%, which is paid annually. The principal is due in five years.

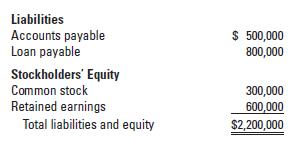

The Liability and Equity categories of Second Company at year-end appeared as follows:

Second Company’s preferred stock is 8%, cumulative. A provision of the stock agreement specifies that the stock must be redeemed at face value in five years.

Required 1. It appears that the loan payable of First Company and the preferred stock of Second Company are very similar. What are the differences between the two securities?

2. When calculating the debt-to-equity ratio, do you believe that the Second Company preferred stock should be treated as debt or as stockholders’ equity? Write a statement expressing your position on the issue.

Step by Step Answer:

Financial Accounting The Impact On Decision Makers

ISBN: 9780324655230

6th Edition

Authors: Gary A. Porter, Curtis L. Norton