Interpreting The New York Times Companys Financial Statements The 2006 annual report of The New York Times

Question:

Interpreting The New York Times Company’s Financial Statements The 2006 annual report of The New York Times Company includes the following note:

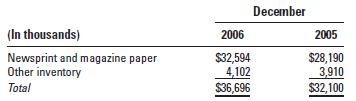

6. Inventories Inventories as shown in the accompanying Consolidated Balance Sheets were as follows:

Inventories are stated at the lower of cost or current market value. Cost was determined utilizing the LIFO method for 78% of inventory in 2006 and 77% of inventory in 2005. The replacement cost of inventory was approximately $45 million as of December 2006 and $40 million as of December 2005.

Required 1. What types of inventory costs does The New York Times Company carry? What about newspapers?

Are newspapers considered inventory?

2. Why would the company choose more than one method to value its inventory?

Step by Step Answer:

Financial Accounting The Impact On Decision Makers

ISBN: 9780324655230

6th Edition

Authors: Gary A. Porter, Curtis L. Norton