Inventory Costing MethodsPeriodic System Story Companys inventory records for the month of November reveal the following: Selling

Question:

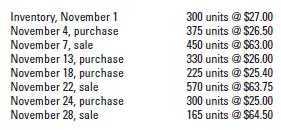

Inventory Costing Methods—Periodic System Story Company’s inventory records for the month of November reveal the following:

Selling and administrative expenses for the month were $16,200. Depreciation expense was $6,000. Story’s tax rate is 35%.

Required 1. Calculate the cost of goods sold and ending inventory under each of the following three methods assuming a periodic inventory system:

(a) FIFO,

(b) LIFO, and

(c) weighted average.

2. Calculate the gross profit and net income under each costing assumption.

3. Under which costing method will Story pay the least taxes? Explain your answer.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting The Impact On Decision Makers

ISBN: 9780324655230

6th Edition

Authors: Gary A. Porter, Curtis L. Norton

Question Posted: