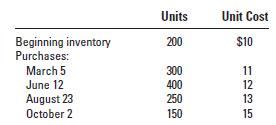

Inventory Costing MethodsPeriodic System The following information is available concerning the inventory of Carter Inc.: During the

Question:

Inventory Costing Methods—Periodic System The following information is available concerning the inventory of Carter Inc.:

During the year, Carter sold 1,000 units. It uses a periodic inventory system.

Required 1. Calculate ending inventory and cost of goods sold for each of the following three methods:

a. Weighted average

b. FIFO

c. LIFO 2. Assume an estimated tax rate of 30%. How much more or less (indicate which) will Carter pay in taxes by using FIFO instead of LIFO? Explain your answer.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting The Impact On Decision Makers

ISBN: 9780324655230

6th Edition

Authors: Gary A. Porter, Curtis L. Norton

Question Posted: