It is December 2021, and Sharon Sowers, the CEO of Mallory Services, has decided to sell the

Question:

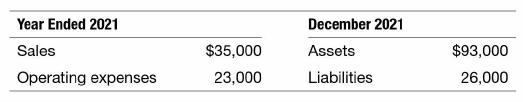

It is December 2021, and Sharon Sowers, the CEO of Mallory Services, has decided to sell the clerical division. She has received an offer for $105,000 but is undecided about whether she wishes to complete the sale in 2021 or 2022. She is currently evaluating the effects of the sale on 2021 reported net income. Income from continuing operations for 2021 is estimated to be $950,000 (excluding the activities of the clerical division), and information about the clerical division is as follows. The company's tax rate is 25 percent.

a. Prepare the 2021 income statement, beginning with net income from continuing operations, assuming that Sharon accepts the offer, and explain how a user might interpret the items on the income statement in terms of earnings persistence.

b. Prepare the 2021 income statement, beginning with net income from continuing operations, assuming that Sharon chooses not to sell the division in 2021, and explain how a user might interpret the items on the income statement in terms of earnings persistence.

c. Describe some of the important trade-offs Sharon faces as she decides whether to complete the sale in 2021 or 2022.

Step by Step Answer: