Liquidity Analyses for McDonalds and Wendys The following information was summarized from the balance sheets of McDonalds

Question:

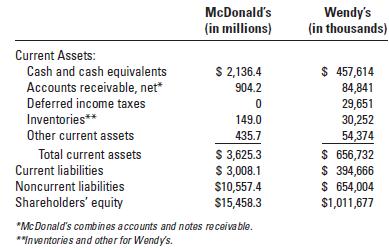

Liquidity Analyses for McDonald’s and Wendy’s The following information was summarized from the balance sheets of McDonald’s Corporation andWendy’s International Inc. at December 31, 2006.

Required 1. Using the information provided, compute the following for each company at year end:

a. Working capital

b. Current ratio

c. Quick ratio 2. Comment briefly on the liquidity of each of these two companies. Which appears to be more liquid?

3. McDonald’s reported cash flows from operations of $4,341.5 million during 2006. Wendy’s reported cash flows from operations of $271,379 thousand. Current liabilities reported by McDonald’s at December 31, 2005, and Wendy’s at January 1, 2006, were $4,107.7 million and $583,352 thousand, respectively. Calculate the cash flow from operations to current liabilities ratio for each company. Does the information provided by this ratio change your opinion as to the relative liquidity of each of these two companies?

Step by Step Answer:

Financial Accounting The Impact On Decision Makers

ISBN: 9780324655230

6th Edition

Authors: Gary A. Porter, Curtis L. Norton