P11-77B. (Learning Objectives 3, 4, 5, 6: Preparing the statement of cash flowsindirect and direct methods) The

Question:

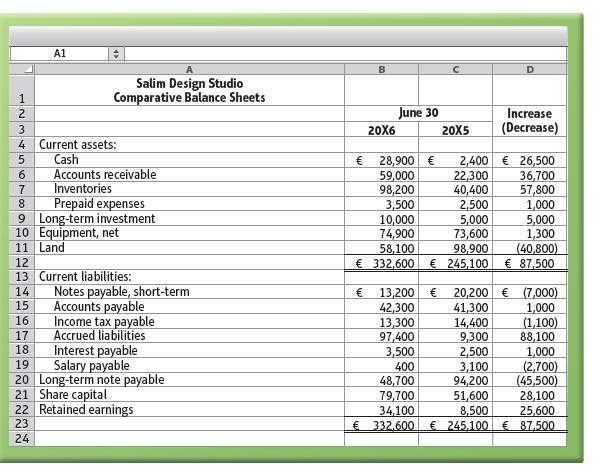

P11-77B. (Learning Objectives 3, 4, 5, 6: Preparing the statement of cash flows—indirect and direct methods) The comparative Balance Sheets of Salim Design Studio, Inc., at June 30, 20X6 and 20X5, and transaction data for fiscal year 20X6 are as follows:

.

.

Transaction data for the year ended June 30, 20X6:

a. Net income, €73,500

b. Depreciation expense on equipment, €14,000

c. Purchased long-term investment, €5,000

d. Sold land for €33,700, including €7,000 loss

e. Acquired equipment by issuing long-term note payable, €15,300

f. Paid long-term note payable, €60,800 g. Received cash for issuance of shares, €21,200 h. Paid cash dividends, €47,900 i. Paid short-term note payable by issuing shares, €7,000 Requirements 1. Prepare the statement of cash flows of Salim Design Studio, Inc., for the year ended June 30, 20X6, using the indirect method to report operating activities. Also prepare the accompanying schedule of noncash investing and financing activities. All current accounts except short-term notes payable result from operating transactions.

2. Prepare a supplementary schedule showing cash flows from operations by the direct method. The accounting records provide the following: collections from customers, €272,700; interest received, €1,400; payments to suppliers, €130,900; payments to employees, €40,000; payments for income tax, €12,600; and payment of interest, €5,300.

Step by Step Answer:

Financial Accounting International Financial Reporting Standards Global Edition

ISBN: 9781292211145

11th Edition

Authors: Charles T. Horngren, C. William Thomas, Wendy M. Tietz, Themin Suwardy, Walter T. Harrison