P12-61B. (Learning Objective 4: Using ratios to evaluate a share investment) Comparative financial statement data of Schmid

Question:

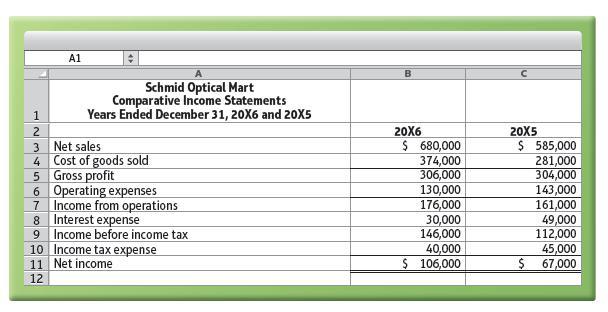

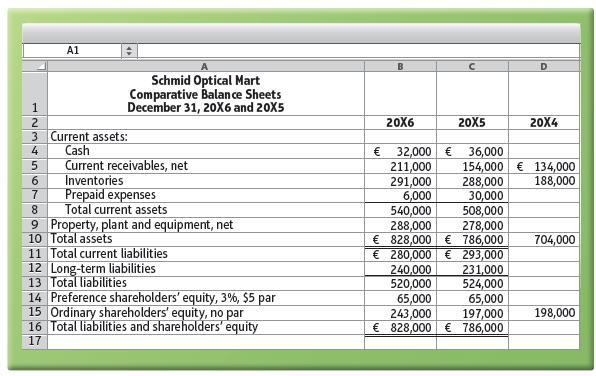

P12-61B. (Learning Objective 4: Using ratios to evaluate a share investment) Comparative financial statement data of Schmid Optical Mart follow:

Other information:

1. Market price of Schmid ordinary share: €78.12 at December 31, 20X6, and €59.10 at December 31, 20X5.

2. Ordinary shares outstanding: 19,000 during 20X6 and 17,000 during 20X5.

Requirements 1. Compute the following ratios for 20X6 and 20X5:

a. Current ratio

d. Return on ordinary shareholders’ equity

b. Inventory turnover

e. Earnings per ordinary share

c. Times-interest-earned ratio

f. Price/earnings ratio 2. Decide whether

(a) Schmid’s financial position improved or deteriorated during 20X6 and

(b) the investment attractiveness of Schmid’s ordinary shares appears to have increased or decreased.

3. How will what you have learned in this problem help in the evaluation of an investment?

Step by Step Answer:

Financial Accounting International Financial Reporting Standards Global Edition

ISBN: 9781292211145

11th Edition

Authors: Charles T. Horngren, C. William Thomas, Wendy M. Tietz, Themin Suwardy, Walter T. Harrison