P12-62B. (Learning Objectives 4, 5: Using ratios to decide between two share investments; measuring economic value added)

Question:

P12-62B. (Learning Objectives 4, 5: Using ratios to decide between two share investments;

measuring economic value added) Assume that you are considering purchasing shares as an investment. You have narrowed the choice to CDROM and E-shop Stores and have assembled the following data.

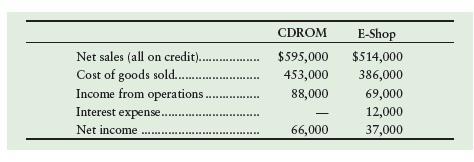

Selected Income Statement data for current year:

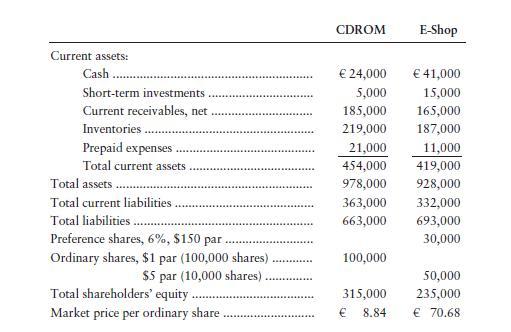

Selected Balance Sheet and market price data at the end of the current year:

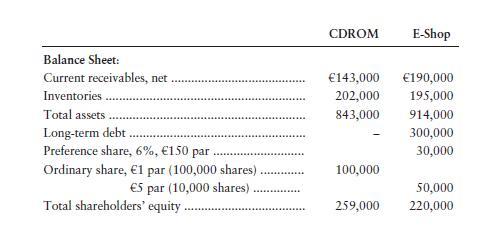

Selected Balance Sheet data at the beginning of the current year:

Your strategy is to invest in companies that have low price/earnings ratios, but which appear to be in good shape financially. Assume that you have analyzed all other factors and that your decision depends on the results of ratio analysis.

Requirements 1. Compute the following ratios for both companies for the current year and decide which company’s shares better fit your investment strategy.

a. Acid-test ratio

e. Times-interest-earned ratio

b. Inventory turnover

f. Return on ordinary shareholders’ equity

c. Receivables resident period g. Earnings per share

d. Debt ratio h. Price/earnings ratio 2. Compute each company’s economic-value-added (EVA®) measure and determine whether the companies’ EVA®s confirm or alter your investment decision. Each company’s cost of capital is 12%. Use unadjusted net income in your calculations.

Step by Step Answer:

Financial Accounting International Financial Reporting Standards Global Edition

ISBN: 9781292211145

11th Edition

Authors: Charles T. Horngren, C. William Thomas, Wendy M. Tietz, Themin Suwardy, Walter T. Harrison