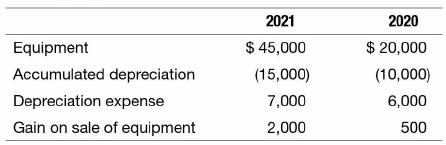

The following information was taken from the records of Dylan's Toys: Equipment with a cost of $8,000

Question:

The following information was taken from the records of Dylan's Toys:

Equipment with a cost of $8,000 was sold during 2021.

a. How much equipment was purchased during 2021?

b. How much cash was collected on the sale of the equipment during 2021?

c. Provide the journal entry to record the sale of the equipment.

Transcribed Image Text:

2021 2020 Equipment $ 45,000 $ 20,000 Accumulated depreciation (15,000) (10,000) Depreciation expense 7,000 6,000 Gain on sale of equipment 2,000 500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (10 reviews)

a 45000 Equipment cost 8000 37000 equip...View the full answer

Answered By

Abdullah Waseem

Hello! I’m Abdullah Waseem! I have completed my graduation in Accounting & Finance from the University of Central Punjab, Lahore. I specialize in Finance, Accounting, Business, Management, Marketing, and Auditing. I have many experiences working as a content developer/writer. I have completed many projects for my clients and I have completed many assignments/expert questions for students globally. I always look for opportunities and for better growth. I’m sure that I will work efficiently with your online website. I have been online tutoring since I was doing my degree. I've helped so many students achieve their academic goals year after year. I always feel good while tutoring the students and providing help to complete their requirements. I can help you in completing the assignments and different projects. I am looking forward to working for you and being able to meet your work requirements and hope to work with you soon as well.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The following information was taken from the records of Presley Inc. for the year 2014: The following additional information was also available: income tax applicable to income from continuing...

-

The following information was taken from the records of Clarkson Motorsports, Inc., at November 30, 2012: Requirement 1. Prepare a multi-step income statement for Clarkson Motorsports for the fiscal...

-

The following information was taken from the records of Daughtry Motorsports, Inc., at November 30, 2012: Requirement 1. Prepare a multi-step income statement for Daughtry Motorsports for the fiscal...

-

Write the appropriate SQL statement for the following queries. The result of the queries will be checked from your computer. What privilege should a user be given to log on to the Oracle server? Is...

-

Calculate the price of a $25,000, 91-day Province of British Columbia Treasury bill on its issue date if the current market rate of return is 3.672%.

-

Assume the same facts as in Problem 54. On the first day of the third tax year, the partnership sold the equipment for $150,000. The gain on the sale is allocated equally to the partners. The...

-

Facility layout and material flowpath design are major factors in the productivity analysis of automated manufacturing systems. Facility layout is concerned with the location arrangement of machines...

-

Outside Environment, Inc. provides commercial landscaping services in San Diego. Sasha Cairns, the firms owner, wants to develop cost estimates that she can use to prepare bids on jobs. After...

-

The plant asset and accumulated depreciation accounts of Pell Corporation had the following balances at December 3 1 , 2 0 2 0 : Transactions during 2 0 2 1 were as follows: a . On January 2 , 2 0 2...

-

Calculate the magnetic flux density for the current distribution in free space to be A=(3x'y+ yz)a, +(xy xz' )a, -(7xyz - 3x'y)a, Wb/m. (a) a, (-7xz+6xy+3xz)+ a, (-3x - ) (b) a, (-7z+...

-

Airbus, a global French aircraft manufacturer, prepares its financial statements in accordance with IFRS. On its 2019 income statement, it reported a net loss of approximately 1.3 billlion euros,...

-

Excerpts from the 2019 financial statements of General Mills are as follows ( dollars in millions): For 2019, compute estimates of cash receipts from customers and cash payments to suppliers. Assume...

-

Consider the following summary measures for the annual returns for Vanguards Energy Fund and Vanguards Health Care Fund from 2005 through 2017. Energy: x = 9.62% and s = 23.58% Health Care: x =...

-

Answer the following problems with solution: Use the following information for the next two questions: The statement of financial position of the partnership of A and B as of December 31, 20x1 is...

-

Complete the following budgets 1 Production Budget Planned Sales Desired Ending Inventory of Finished Goods (roundup to the next unit) Total Needed Less: Beginning Inventory Total Production {7.01}

-

Solution needs urgently. Question 1 (5 points) In times of prosperity (with high incomes and employment), governments at all levels have resources for high cost infrastructure such as roads,...

-

Write a program (called assignment-1.cxx)-- (40 points) Write down the C++ program based on the following tasks. Creates an Array (1D array) and randomly assign values. Show the array with assigned...

-

on 17:03 Sat 11 May < 00 194843... 19871 II B itsSUNPI is live! + Hi mates im Alive chating and all the fun stuf that we do O COME & GET ME! -- Sunpi FE now Untitled... HYPE RESULTS T Potential...

-

Given that corporate clients largely cannot operate without relying on Ticketmaster today, do you think sport teams and franchises should be concerned about being etched out of the ticketing business...

-

If the amplifier indicated by the box input impedance of oo, which of the following statements are true ? has an open loop gain as well as Feedback factor (\beta = 1/ R_1\) The feedback is voltage...

-

For each of the following items before adjustment, indicate the type of adjusting entryprepaid expense, unearned revenue, accrued revenue, and accrued expense that is needed to correct the...

-

One-half of the adjusting entry is given below. Indicate the account title for the other half of the entry. (a) Salaries and Wages Expense is debited. (b) Depreciation Expense is debited. (c)...

-

One-half of the adjusting entry is given below. Indicate the account title for the other half of the entry. (a) Salaries and Wages Expense is debited. (b) Depreciation Expense is debited. (c)...

-

The payroll register of Ruggerio Co. indicates $13,800 of social security withheld and $3,450 of Medicare tax withheld on total salaries of $230,000 for the period. Federal withholding for the period...

-

All of the following are included on Form 1040, page 1, EXCEPT: The determination of filing status. The Presidential Election Campaign check box. The income section. The paid preparer signature line.

-

Question One: (25 marks) (X) Inc. purchased 80% of the outstanding voting shares of (Y) for $360,000 on July 1, 2017. On that date, (Y) had common shares and retained earnings worth $180,000 and...

Study smarter with the SolutionInn App